LEASE

BETWEEN

EMERYSTATION TRIANGLE, LLC

a California limited liability company (LANDLORD)

AND

XOMA CORPORATION,

a Delaware corporation (TENANT)

5860 and 5864 Hollis Street

Emeryville, California 94608

|

ARTICLE 1 BASIC LEASE PROVISIONS

|

1

|

| |

|

|

1.1

|

BASIC LEASE PROVISIONS

|

1

|

| |

|

|

|

1.2

|

ENUMERATION OF EXHIBITS AND RIDER

|

3

|

| |

|

|

|

1.3

|

DEFINITIONS

|

3

|

| |

|

|

|

ARTICLE 2 PREMISES, TERM, CONDITION OF PREMISES, RENEWAL

|

7

|

| |

|

|

2.1

|

LEASE OF PREMISES

|

7

|

| |

|

|

|

2.2

|

TERM

|

7

|

| |

|

|

|

2.3

|

CONDITION OF PREMISES

|

7

|

| |

|

|

|

2.4

|

[INTENTIONALLY OMITTED]

|

8

|

| |

|

|

|

2.5

|

RENEWAL OPTION

|

8

|

| |

|

|

|

ARTICLE 3 RENT

|

10

|

| |

|

|

ARTICLE 4 RENT ADJUSTMENTS AND PAYMENTS

|

10

|

| |

|

|

4.1

|

RENT ADJUSTMENTS

|

10

|

| |

|

|

|

4.2

|

STATEMENT OF LANDLORD

|

11

|

| |

|

|

|

4.3

|

BOOKS AND RECORDS

|

12

|

| |

|

|

|

4.4

|

TENANT OR LEASE SPECIFIC TAXES

|

12

|

| |

|

|

|

ARTICLE 5 SECURITY DEPOSIT

|

13

|

| |

|

|

ARTICLE 6 UTILITIES AND SIGNAGE

|

13

|

| |

|

|

6.1

|

UTILITIES GENERALLY

|

13

|

| |

|

|

|

6.2

|

INTERRUPTION OF USE

|

14

|

| |

|

|

|

6.3

|

SIGNAGE

|

15

|

| |

|

|

|

ARTICLE 7 POSSESSION, USE AND CONDITION OF PREMISES

|

15

|

| |

|

|

7.1

|

POSSESSION AND USE OF PREMISES

|

15

|

| |

|

|

|

7.2

|

LANDLORD ACCESS TO PREMISES; APPROVALS

|

25

|

| |

|

|

|

7.3

|

QUIET ENJOYMENT

|

26

|

| |

|

|

|

ARTICLE 8 MAINTENANCE

|

26

|

| |

|

|

8.1

|

LANDLORD’S MAINTENANCE

|

26

|

| |

|

|

|

8.2

|

TENANT’S MAINTENANCE

|

27

|

| |

|

|

|

ARTICLE 9 ALTERATIONS AND IMPROVEMENTS

|

27

|

| |

|

|

9.1

|

TENANT ALTERATIONS

|

27

|

| |

|

|

|

9.2

|

LIENS

|

29

|

| |

|

|

|

ARTICLE 10 ASSIGNMENT AND SUBLETTING

|

30

|

| |

|

|

10.1

|

ASSIGNMENT AND SUBLETTING

|

30

|

|

10.2

|

RECAPTURE

|

32

|

| |

|

|

|

10.3

|

EXCESS RENT

|

32

|

| |

|

|

|

10.4

|

TENANT LIABILITY

|

32

|

| |

|

|

|

10.5

|

ASSUMPTION AND ATTORNMENT

|

33

|

| |

|

|

| 10.6 |

PROCESSING EXPENSES

|

33 |

| |

|

|

| ARTICLE 11 DEFAULT AND REMEDIES |

33

|

| |

|

|

11.1

|

EVENTS OF DEFAULT

|

33

|

| |

|

|

|

11.2

|

LANDLORD’S REMEDIES

|

34

|

| |

|

|

|

11.3

|

ATTORNEY’S FEES

|

36

|

| |

|

|

|

11.4

|

BANKRUPTCY

|

37

|

| |

|

|

| 11.5 |

LANDLORD’S DEFAULT |

38

|

| |

|

|

ARTICLE 12 SURRENDER OF PREMISES

|

38 |

| |

|

| 12.1 |

IN GENERAL |

38

|

| |

|

|

| 12.2 |

LANDLORD’S RIGHTS |

39

|

| |

|

|

| ARTICLE 13 HOLDING OVER |

39

|

| |

|

| ARTICLE 14 DAMAGE BY FIRE OR OTHER CASUALTY |

39

|

| |

|

| 14.1 |

SUBSTANTIAL UNTENANTABILITY |

39

|

| |

|

|

| 14.2 |

INSUBSTANTIAL UNTENANTABILITY |

40

|

| |

|

|

| 14.3 |

RENT ABATEMENT |

40

|

| |

|

|

| 14.4 |

WAIVER OF STATUTORY REMEDIES |

41

|

| |

|

|

|

ARTICLE 15 EMINENT DOMAIN

|

41

|

| |

|

|

15.1

|

TAKING OF WHOLE OR SUBSTANTIAL PART

|

41

|

| |

|

|

|

15.2

|

TAKING OF PART

|

41

|

| |

|

|

|

15.3

|

COMPENSATION

|

42

|

| |

|

|

|

ARTICLE 16 INSURANCE

|

42

|

| |

|

|

16.1

|

TENANT’S INSURANCE

|

42

|

| |

|

|

|

16.2

|

FORM OF POLICIES

|

42

|

| |

|

|

|

16.3

|

LANDLORD’S INSURANCE

|

43

|

| |

|

|

|

16.4

|

WAIVER OF SUBROGATION

|

43

|

| |

|

|

|

16.5

|

NOTICE OF CASUALTY

|

44

|

| |

|

|

|

ARTICLE 17

|

WAIVER OF CLAIMS AND INDEMNITY

|

44

|

| |

|

|

| 17.1 |

WAIVER OF CLAIMS

|

44

|

| |

|

|

|

17.2

|

INDEMNITY BY TENANT

|

45

|

|

17.3

|

INDEMNITY BY LANDLORD

|

45

|

| |

|

|

|

ARTICLE 18 RULES AND REGULATIONS

|

46

|

| |

|

|

18.1

|

RULES

|

46

|

| |

|

|

|

18.2

|

ENFORCEMENT

|

46

|

| |

|

|

|

ARTICLE 19 LANDLORD’S RESERVED RIGHTS

|

46

|

| |

|

|

ARTICLE 20 ESTOPPEL CERTIFICATE

|

47

|

| |

|

|

20.1

|

IN GENERAL

|

47

|

| |

|

|

|

20.2

|

ENFORCEMENT

|

47

|

| |

|

|

|

ARTICLE 21 INTENTIONALLY OMITTED

|

47

|

| |

|

|

ARTICLE 22 REAL ESTATE BROKERS

|

47

|

| |

|

|

ARTICLE 23 MORTGAGEE PROTECTION

|

48

|

| |

|

|

23.1

|

SUBORDINATION AND ATTORNMENT

|

48

|

| |

|

|

|

23.2

|

MORTGAGEE PROTECTION

|

49

|

| |

|

|

|

ARTICLE 24 NOTICES

|

49

|

| |

|

|

ARTICLE 25 MISCELLANEOUS

|

50

|

| |

|

|

25.1

|

LATE CHARGES

|

50

|

| |

|

|

|

25.2

|

NO JURY TRIAL; VENUE; JURISDICTION

|

50

|

| |

|

|

|

25.3

|

DISCRIMINATION

|

51

|

| |

|

|

|

25.4

|

FINANCIAL STATEMENTS

|

51

|

| |

|

|

|

25.5

|

OPTION

|

51

|

| |

|

|

|

25.6

|

TENANT AUTHORITY

|

52

|

| |

|

|

|

25.7

|

ENTIRE AGREEMENT

|

52

|

| |

|

|

|

25.8

|

MODIFICATION OF LEASE FOR BENEFIT OF MORTGAGEE

|

52

|

| |

|

|

|

25.9

|

EXCULPATION

|

52

|

| |

|

|

|

25.10

|

ACCORD AND SATISFACTION

|

52

|

| |

|

|

|

25.11

|

LANDLORD’S OBLIGATIONS ON SALE OF BUILDING

|

53

|

| |

|

|

|

25.12

|

BINDING EFFECT

|

53

|

| |

|

|

|

25.13

|

CAPTIONS

|

53

|

| |

|

|

|

25.14

|

TIME; APPLICABLE LAW; CONSTRUCTION

|

53

|

| |

|

|

|

25.15

|

ABANDONMENT

|

53

|

| |

|

|

|

25.16

|

LANDLORD’S RIGHT TO PERFORM TENANT’S DUTIES

|

54

|

| |

|

|

|

25.17

|

SECURITY SYSTEM

|

54

|

| |

|

|

|

25.18

|

NO LIGHT, AIR OR VIEW EASEMENTS

|

54

|

|

25.19

|

RECORDATION |

54

|

| |

|

|

| 25.20 |

SURVIVAL |

54

|

| |

|

|

| 25.21 |

OFAC REPRESENTATION, WARRANTY AND COVENANT

|

54

|

| |

|

|

| 25.22 |

OPC REQUIREMENTS

|

55

|

| |

|

|

| 25.23 |

COUNTERPARTS

|

56

|

| |

|

|

| 25.24 |

BACKUP GENERATOR

|

56

|

| |

|

|

| 25.25 |

ROOFTOP EQUIPMENT

|

57

|

| |

|

|

| 25.26 |

EQUIPMENT FINANCING

|

58

|

| |

|

|

| 25.27 |

RIDERS

|

58

|

WAREHOUSE LEASE

ARTICLE 1

BASIC LEASE PROVISIONS

| |

|

|

1.1

|

BASIC LEASE PROVISIONS

|

In the event of any conflict between these Basic Lease Provisions and any other Lease provision, such other Lease provision shall control.

| |

|

|

| |

(1)

|

BUILDING AND ADDRESS:

|

| |

|

|

| |

|

5860 and 5864 Hollis Street

|

| |

|

Emeryville, California 94608

|

| |

|

|

| |

(2)

|

LANDLORD AND ADDRESS:

|

| |

|

|

| |

|

Emerystation Triangle, LLC

|

| |

|

1120 Nye Street, Suite 400

|

| |

|

San Rafael, California 94901

|

| |

|

|

| |

|

Notices to Landlord shall be addressed:

|

| |

|

|

| |

|

Emerystation Triangle, LLC

|

| |

|

c/o Wareham Development Corporation

|

| |

|

1120 Nye Street, Suite 400

|

| |

|

San Rafael, California 94901

|

| |

|

|

| |

|

With a copy to:

|

| |

|

|

| |

|

Shartsis Friese LLP

|

| |

|

One Maritime Plaza, 18th Floor

|

| |

|

San Francisco, California 94901

|

| |

|

Attention: David H. Kremer, Esq.

|

| |

|

|

| |

(3)

|

TENANT AND ADDRESS:

|

| |

|

|

| |

|

(a)

|

Name: XOMA CORPORATION

|

| |

|

|

|

| |

|

(b)

|

State of formation: Delaware

|

| |

|

|

|

| |

|

Notices to Tenant shall be addressed:

|

| |

|

|

| |

|

XOMA(US) LLC

|

| |

|

2910 Seventh Street

|

| |

|

Berkeley, CA 94710

|

| |

|

Attn: Legal Department

|

| |

|

with copies to:

|

| |

|

|

| |

|

XOMA(US) LLC

|

| |

|

2910 Seventh Street

|

| |

|

Berkeley, CA 94710

|

| |

|

Attn:

|

CFO

|

| |

|

|

| |

(4)

|

DATE OF THIS LEASE: February 13, 2013

|

| |

|

|

| |

(5)

|

LEASE TERM: Ten (10) years, subject to any option(s) set forth in Section 2.5 below.

|

| |

|

|

| |

(6)

|

COMMENCEMENT DATE: May 1, 2013

|

| |

|

|

| |

(7)

|

EXPIRATION DATE: April 30, 2023

|

| |

|

|

| |

(8)

|

MONTHLY BASE RENT:

|

|

PERIOD FROM/TO

|

MONTHLY BASE RENT

|

|

May 1, 2013 - April 30, 2014

|

$21,685.00

|

|

May 1, 2014 - April 30, 2015

|

$22,335.55

|

|

May 1, 2015 - April 30, 2016

|

$23,005.62

|

|

May 1, 2016 - April 30, 2017

|

$23,695.78

|

|

May 1, 2017 - April 30, 2018

|

$24,406.66

|

|

May 1, 2018 - April 30, 2019

|

$25,138.86

|

|

May 1, 2019 - April 30, 2020

|

$25,893.02

|

|

May 1, 2020 - April 30, 2021

|

$26,669.81

|

|

May 1, 2021 - April 30, 2022

|

$27,469.91

|

|

May 1, 2022 - April 30, 2023

|

$28,294.01

|

| |

|

|

| |

(9)

|

RENTABLE AREA OF THE PREMISES: 16,357 square feet

|

| |

|

|

| |

(10)

|

SECURITY DEPOSIT: $28,294.01

|

| |

|

|

| |

(11)

|

[INTENTIONALLY OMITTED]

|

| |

|

|

| |

(12)

|

TENANT’S USE OF PREMISES: Warehouse and distribution of medical and incidental office/administrative uses

|

| |

|

|

| |

(13)

|

[INTENTIONALLY OMITTED]

|

| |

|

|

| |

(14)

|

TENANT’S BROKER: Cushman & Wakefield

|

| |

|

|

| |

(15)

|

TENANT IMPROVEMENT ALLOWANCE: $81,785.00

|

| |

|

|

|

1.2

|

ENUMERATION OF EXHIBITS AND RIDER

|

The Exhibits and Rider set forth below and attached to this Lease are incorporated in this Lease by this reference:

| |

|

|

| |

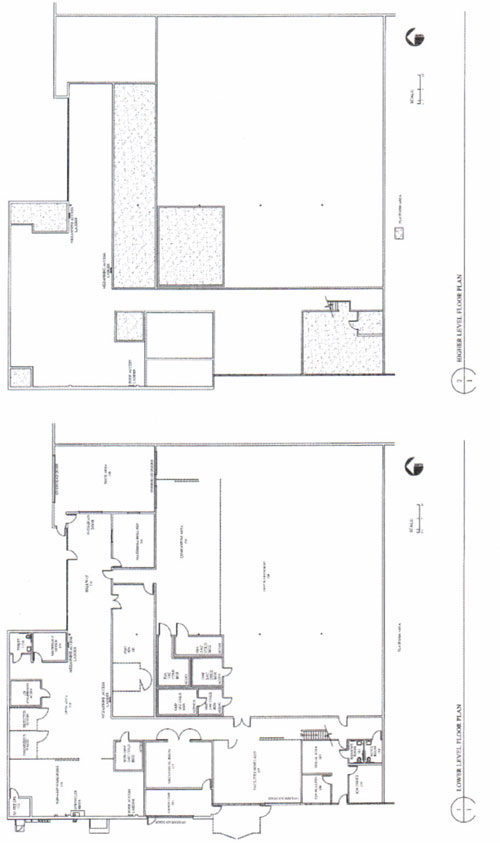

EXHIBIT A

|

Plan of Premises

|

| |

EXHIBIT B

|

Rules and Regulations

|

| |

|

|

|

1.3

|

DEFINITIONS

|

For purposes hereof, the following terms shall have the following meanings:

AFFILIATE: Any corporation or other business entity that is currently owned or controlled by, owns or controls, or is under common ownership or control with Tenant or Landlord, as the case may be.

BUILDING: The building located at the address specified in Section 1.1(1). The Building may include office, warehouse, lab, retail and other uses.

COMMENCEMENT DATE: The date specified in Section 1.1(6).

COMMON AREAS: All areas of the Project made available by Landlord from time to time for the general common use or benefit of the tenants of the Building, and their employees and invitees, or the public, as such areas currently exist and as they may be changed from time to time.

DECORATION: Tenant Alterations which do not require a building permit and which do not involve any of the structural elements of the Building, or any of the Building’s systems, including its electrical, mechanical, plumbing, security, heating, ventilating, air-conditioning, communication, and fire and life safety systems.

DEFAULT RATE: Two (2) percentage points above the rate then most recently announced by Bank of America N.T.&S.A. at its San Francisco main office as its base lending reference rate, from time to time announced, but in no event higher than the maximum rate permitted by Law.

EXPIRATION DATE: The date specified in Section 1.1(7).

FORCE MAJEURE: Any accident, casualty, act of God, war or civil commotion, strike or labor troubles, or any cause whatsoever beyond the reasonable control of a party, including water shortages, energy shortages or governmental preemption in connection with an act of God, a national emergency, or by reason of Law, or by reason of the conditions of supply and demand which have been or are affected by act of God, war or other emergency.

INDEMNITEES: Collectively, Landlord, any Mortgagee or ground lessor of the Property, the property manager and the leasing manager for the Property and their respective partners, members, directors, officers, agents and employees.

LAND: The parcel(s) of real estate on which the Building and Project are located.

LAWS OR LAW: All laws, ordinances, rules, regulations, other requirements, orders, rulings or decisions adopted or made by any governmental body, agency, department or judicial authority having jurisdiction over the Property, the Premises or Tenant’s activities at the Premises and any covenants, conditions or restrictions of record which affect the Property.

LEASE: This instrument and all exhibits and riders attached hereto, as may be amended from time to time.

MONTHLY BASE RENT: The monthly rent specified in Section 1.1(8).

MORTGAGEE: Any holder of a mortgage, deed of trust or other security instrument encumbering the Property.

OPERATING EXPENSES: All costs, expenses and disbursements of every kind and nature which Landlord shall pay or become obligated to pay in connection with the ownership, management, operation, maintenance, replacement and repair of the Building and the Property, (as well as the reasonable allocation by Landlord of any expenses incurred and related to facilities located on other property owned or managed by Landlord or affiliates of Landlord, if the Property is managed as part of a portfolio involving more than one building and/or property) including, without limitation, (1) property management fees (not to exceed 3.5% of the Project’s gross receipts); (2) costs of a commercially reasonable property management office and office operation; (3) insurance costs relating to the Project; (4) costs and expenses of any capital expenditure or improvement, amortized over the useful life of the applicable capital expenditure or improvement, in accordance with generally accepted accounting principles, together with interest thereon on the unamortized costs at the lower of the rate incurred by Landlord to finance such capital expenditure or improvement or the Default Rate, which capital expenditure or improvement (a) is made to the Property after the Commencement Date in order to comply with Laws enacted after the Commencement Date, or (b) is installed for the purpose of reducing or controlling Operating Expenses; and (5) if the Property is part of a multi-building portfolio, the Building’s allocated share (as reasonably and equitably determined by Landlord according to sound real estate accounting and management principles, consistently applied) of those expenses incurred on a portfolio-wide basis benefiting the Building and/or Property which may include, without limitation, costs such as (a) landscaping, (b) utility and road repairs, and (c) security. Operating Expenses shall not include, (i) costs of alterations of the premises of tenants of the Project, (ii) costs of capital improvements to the Project (except as permitted in clause (4) above in the definition of ‘‘Operating Expenses”), (iii) depreciation charges, (iv) interest and principal payments on loans (except for loans for capital improvements which Landlord is allowed to include in Operating Expenses as provided above), (v) ground rental payments, (vi) real estate brokerage and leasing commissions or any fee in lieu of commission, (vii) advertising and marketing expenses, (viii) costs of Landlord reimbursed by insurance proceeds, condemnation awards, a tenant of the Project (outside of such tenant’s Operating Expense payments) or otherwise to the extent so reimbursed, (ix) expenses incurred in negotiating leases of tenants in the Project or enforcing lease obligations of tenants in the Project, (x) Landlord’s general corporate overhead, (xi) costs incurred by Landlord due to the violation by Landlord or any other tenant of the terms and conditions of any lease of space in the Project or any law, code, regulation, ordinance or the like, (xii) any compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord, (xiii); bad debt expenses and interest, principal, points and fees on debts (except in connection with the financing of items which may be included in Operating Expenses); (xiv) marketing costs, attorneys’ fees in connection with the negotiation and preparation of letters, deal memos, letters of intent, leases, subleases and/or assignments, space planning costs, and other costs and expenses incurred in connection with lease, sublease and/or assignment negotiations and transactions with present or prospective tenants or other occupants of the Project, including attorneys’ fees and other costs and expenditures incurred in connection with disputes with present or prospective tenants or other occupants of the Project; (xv) costs, including permit, license and inspection costs, incurred with respect to the installation of other tenants’ or occupants’ improvements made for tenants or other occupants in the Project or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants in the Project; (xvi) any costs expressly excluded from Operating Expenses elsewhere in this Lease; (xvii) expenses in connection with services or other benefits which are not offered to Tenant or for which Tenant is charged for directly but which are provided to another tenant or occupant of the Project, without charge; (xviii) costs (including in connection therewith all attorneys’ fees and costs of settlement, judgments and/or payments in lieu thereof) arising from claims, disputes or potential disputes in connection with potential or actual claims, litigation or arbitrations pertaining to Landlord and/or the Project; (xix) costs associated with the operation of the business of the partnership which constitutes Landlord as the same are distinguished from the costs of operation of the Project; (xx) costs incurred to remove, remedy, contain, or treat any Hazardous Material; provided, however, that (A) the costs of routine monitoring of and testing for Hazardous Material in, on, or about the Property, and (B) costs incurred in the cleanup or remediation of de minimis amounts of Hazardous Material customarily used in commercial buildings or used to operate motor vehicles and customarily found in parking facilities shall be included as Operating Expenses; (xxi) costs of utilities provided to any other tenant’s space in the Project. If any Operating Expense, though paid in one year, relates to more than one calendar year, at the option of Landlord such expense may be proportionately allocated among such related calendar years.

PREMISES: The space located in the Building as depicted on Exhibit A attached hereto.

PRIOR LEASE: That certain lease agreement for the Premises between Landlord’s predecessor and Tenant’s predecessor, dated as of November 2, 2001 and as subsequently amended on October 16, 2007 and November 20, 2010.

PROJECT or PROPERTY: The Project consists of the building located at the street address specified in Section 1.1(1) in Emeryville, California, associated parking as designated by Landlord from time to time, landscaping and improvements, together with the Land, any associated interests in real property and the building thereon, and the personal property, fixtures, machinery, equipment, systems and apparatus located in or used in conjunction with any of the foregoing that is owned by Landlord. The Project may also be referred to as the Property.

REAL PROPERTY: The Property excluding any personal property.

RENT: Collectively, Monthly Base Rent, Rent Adjustments and Rent Adjustment Deposits, and all other charges, payments, late fees or other amounts required to be paid by Tenant under this Lease.

RENT ADJUSTMENT: Any amounts owed by Tenant for payment of Operating Expenses and/or Taxes. The Rent Adjustments shall be determined and paid as provided in Article 4.

RENT ADJUSTMENT DEPOSIT: An amount equal to Landlord’s estimate of the Rent Adjustment attributable to each month of the applicable calendar year (or partial calendar year) during the Term. On or before the Commencement Date and with each Landlord’s Statement (defined in Article 4), Landlord may reasonably estimate and notify Tenant in writing of its estimate of the Operating Expenses and of Taxes for such calendar year (or partial calendar year). Prior to the first determination by Landlord of the amount of Operating Expenses and of Taxes for the first calendar year (or partial calendar year), Landlord may reasonably estimate such amounts in the foregoing calculation. The last estimate by Landlord shall remain in effect as the applicable Rent Adjustment Deposit unless and until Landlord notifies Tenant in writing of a change, which notice may be given by Landlord from time to time during each year throughout the Term.

RENTABLE AREA OF THE PREMISES: The amount of square footage set forth in Section 1.1(9) provided, however, that any statement of rentable are set forth in this Lease is an approximation which Landlord and Tenant agree is reasonable and the Monthly Base Rent shall not be subject to revision whether or not the actual square footage is more or less.

SECURITY DEPOSIT: The funds specified in Section 1.1(10), if any, deposited by Tenant with Landlord as security for Tenant’s performance of its obligations under this Lease.

TAXES: All federal, state and local governmental taxes, assessments and charges of every kind or nature, whether general, special, ordinary or extraordinary, which Landlord shall pay or become obligated to pay because of or in connection with the ownership, leasing, management, control, sale, transfer, or operation of the Property or any of its components (including any personal property used in connection therewith), which may also include any rental or similar taxes levied in lieu of or in addition to general real and/or personal property taxes. For purposes hereof, Taxes for any year shall be Taxes which are assessed for any period of such year, whether or not such Taxes are billed and payable in a subsequent calendar year. There shall be included in Taxes for any year the amount of all fees, costs and expenses (including reasonable attorneys’ fees) paid by Landlord during such year in seeking or obtaining any refund or reduction of Taxes, but such fees, costs and expenses shall not exceed the greater of (a) Landlord’s good faith estimation of the amount of refund or reduction of Taxes or (b) the actual amount of refund or reduction of Taxes. Taxes for any year shall be reduced by the net amount of any tax refund received by Landlord attributable to such year. If a special assessment payable in installments is levied against any part of the Property, Taxes for any year shall include only the installment of such assessment and any interest payable or paid during such year. Taxes shall not include (i) any items included in Operating Expenses, (ii) any items paid by Tenant under Section 4.4 below and (iii) any federal or state inheritance, general income, excess profit, franchise, capital stock, gift, estate taxes and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents or receipts attributable to operations at the Property) (“Prohibited Taxes”), except that if a change occurs in the method of taxation resulting in whole or in part in the substitution of any such taxes, or any other assessment, for any Taxes as above defined, such substituted taxes or assessments shall be included in the Taxes.

TENANT ALTERATIONS: Any alterations, improvements, additions, installations or construction in or to the Premises or any Building systems serving the Premises.

TENANT’S SHARE: The percentage that represents the ratio of the Rentable Area of the Premises to the Rentable Area of the Building, as determined by Landlord from time to time. Tenant acknowledges that the Rentable Area of the Premises or Building may change from remeasurement or otherwise during the Term.

TERM: The period specified in Section 1.1(5).

TERMINATION DATE: The Expiration Date or such earlier date as this Lease terminates or Tenant’s right to possession of the Premises terminates.

ARTICLE 2

PREMISES, TERM, CONDITION OF PREMISES, RENEWAL

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises for the Term and upon the terms, covenants and conditions provided in this Lease.

The Term shall be for the period of years specified in Section 1.1(5) and the Commencement Date shall be May 1, 2013.

| |

|

|

2.3

|

CONDITION OF PREMISES

|

Tenant acknowledges that prior to the Commencement Date it will have been, and continue to be, in possession of the Premises pursuant to the Prior Lease. Accordingly, Tenant is, and will be, familiar with the condition of the Premises and shall continue to occupy the Premises in its “as is, where is” condition, with all faults, without any representation, warranty or improvement by Landlord of any kind whatsoever, except as expressly set forth herein.

2.4 [INTENTIONALLY OMITTED]

2.5 RENEWAL OPTION

(a) Tenant shall have two successive options to renew this Lease (each a “Renewal Option”) with respect to the entirety of the Premises for the term of five (5) years each (each a “Renewal Term”), commencing upon expiration of the initial Term, or if the first Renewal Option is exercised, upon the expiration of the first Renewal Term. Each Renewal Option must be exercised, if at all, by written notice given by Tenant to Landlord not earlier than twelve (12) months nor later than nine (9) months prior to expiration of the initial Term (or the first Renewal Term, as applicable). If Tenant properly exercises a Renewal Option, then references in the Lease to the Term shall be deemed to include the Renewal Term. The Renewal Option shall be null and void and Tenant shall have no right to renew this Lease if on the date Tenant exercises the Renewal Option or on the date immediately preceding the commencement date of the Renewal Term (i) a Default beyond the applicable cure period shall have occurred and be continuing hereunder, or (ii) Tenant (A) is then subletting more than fifty percent (50%) of the rentable square footage of the Premises other than in connection with a Permitted Transfer (as defined in Section 10.1(e) below) or (B) has assigned this Lease other than in connection with a Permitted Transfer.

(b) If Tenant properly exercises the Renewal Option, then during the Renewal Term all of the terms and conditions set forth in this Lease as applicable to the Premises during the initial Term shall apply during the Renewal Term, including without limitation the obligation to pay Rent Adjustments, except that (i) Tenant shall accept the Premises in their then “as-is” state and condition and Landlord shall have no obligation to make or pay for any improvements to the Premises (except as determined as part of the Fair Market Rent), and (ii) during the Renewal Term the Monthly Base Rent payable by Tenant shall be ninety-five percent (95%) of the Fair Market Rent during the Renewal Term as hereinafter set forth, except that in no event shall Monthly Base Rent during the Renewal Term be less than ninety-five percent (95%) of the Monthly Base Rent in effect during the last month of the initial Term, or first Renewal Term, as applicable, and shall increase by an annually compounded three percent (3%) during each year of the Renewal Term.

(c) For purposes of this Section, the term “Fair Market Rent” shall mean the rental rate, additional rent adjustment and other charges and increases, if any, for space comparable in size, location and quality of the Premises under primary lease (and not sublease) to new or renewing tenants, for a comparable term with a tenant improvement allowance, if applicable and taking into consideration any concessions and such amenities as existing improvements, parking ratio, view, floor on which the Premises are situated and the like, situated in comparable buildings in Berkeley and Emeryville. The Fair Market Rent shall not take into account any Tenant Alterations or other improvements paid for by Tenant.

(d) If Tenant properly exercises a Renewal Option, Landlord, by notice to Tenant not more than thirty (30) days after Tenant’s exercise of such Renewal Option, shall indicate Landlord’s determination of the Fair Market Rent. Tenant, within fifteen (15) days after the date on which Landlord provides such notice of the Fair Market Rent shall either (i) give Landlord final binding written notice (“Binding Notice”) of Tenant’s acceptance of Landlord’s Determination of the Fair Market Rent, or (ii) if Tenant disagrees with Landlords’ determination, provide Landlord with written notice of Tenant’s election to submit the Fair Market Rent to binding arbitration (the “Arbitration Notice”). If Tenant fails to provide Landlord with either a Binding Notice or Arbitration Notice within such fifteen (15) day period, Tenant shall have been deemed to have given the Binding Notice. If Tenant provides or is deemed to have provided Landlord with a Binding Notice, Landlord and Tenant shall enter into the Renewal Amendment (as defined below) upon the terms and conditions set forth herein.

(e) If the parties are unable to agree upon the Fair Market Rent for the Premises within fifteen (15) days after Landlord’s receipt of the Arbitration Notice, Fair Market Rent as of commencement of the Renewal Term shall be determined as follows:

(1) Within fifteen (15) days after the date Tenant delivers the Arbitration Notice, Tenant, at its sole expense, shall obtain and deliver in writing to Landlord a determination of the Fair Market Rent for the Premises for a term equal to the Renewal Term from a broker (“Tenant’s broker”) licensed in the State of California and engaged in the office and lab markets in Berkeley and Emeryville, California, for at least the immediately preceding five (5) years. If Landlord accepts such determination, Landlord shall provide written notice thereof within fifteen (15) days after Landlord’s receipt of such determination and the Base Rent for the Renewal Term shall be adjusted to an amount equal to the Fair Market Rent determined by Tenant’s broker. Landlord shall be deemed to have rejected Tenant’s determination if Landlord fails to respond within the fifteen (15) day period.

(2) If Landlord provides notice that it rejects, or is deemed to have rejected, such determination, within twenty (20) days after receipt of the determination of Tenant’s broker, Landlord shall designate a broker (“Landlord’s broker”) licensed in the State of California and possessing the qualifications set forth in (1) above. Landlord’s broker and Tenant’s broker shall name a third broker, similarly qualified and who is not then or has not previously acted for either party, within five (5) days after the appointment of Landlord’s broker (“Neutral Broker”).

(3) The Neutral Broker shall determine the Fair Market Rent for the Premises as of the commencement of the Renewal Term within fifteen (15) days after the appointment of such Neutral Broker by choosing the determination of the Landlord’s broker or the Tenant’s broker which is closest to its own determination of Fair Market Rent. The decision of the Neutral Broker shall be binding on Landlord and Tenant.

(f) Landlord shall pay the costs and fees of Landlord’s broker in connection with any determination hereunder, and Tenant shall pay the costs and fees of Tenant’s broker in connection with such determination. The costs and fees of the Neutral Broker shall be paid one-half by Landlord and one-half by Tenant.

(g) If the amount of the Fair Market Rent has not been determined pursuant to this Section 2.5 as of the commencement of the Renewal Term, then Tenant shall continue to pay the Base Rent in effect during the last month of the initial Term (or the first Renewal Term, as applicable) until the amount of the Fair Market Rent is determined. When such determination is made, Tenant shall pay any deficiency to Landlord upon demand.

(h) If Tenant is entitled to and properly exercises its Renewal Option, upon determination of Fair Market Rent pursuant to this Section 2.5, Landlord shall prepare an amendment (the “Renewal Amendment”) to reflect changes in the Base Rent, Term, Expiration Date and other appropriate terms consistent with this Section 2.5. The Renewal Amendment shall be sent to Tenant within fifteen (15) days after determination of Fair Market Rent and, provided the same is accurate, Tenant shall execute and return the Renewal Amendment to Landlord within ten (10) business days after Tenant’s receipt of same, but an otherwise valid exercise of the Renewal Option shall be fully effective whether or not the Renewal Amendment is executed.

ARTICLE 3

RENT

Tenant shall pay to Landlord at the address specified in Section 1.1(2), or to such other persons, or at such other places designated by Landlord, without any prior demand therefor in immediately available funds and without any deduction or offset whatsoever (except as otherwise specifically permitted under this Lease), Rent, including Monthly Base Rent and Rent Adjustments in accordance with Article 4, during the Term. Monthly Base Rent shall be paid monthly in advance on the first day of each month of the Term. Monthly Base Rent shall be prorated for partial months within the Term. Unpaid Rent shall bear interest at the Default Rate from the date due until paid. Tenant’s covenant to pay Rent shall be independent of every other covenant in this Lease.

ARTICLE 4

RENT ADJUSTMENTS AND PAYMENTS

4.1 RENT ADJUSTMENTS

From and after the Commencement Date, Tenant shall pay to Landlord Rent Adjustments with respect to each calendar year (or partial calendar year in the case of the year in which the Commencement Date and the Termination Date occur) as follows as follows:

(a) The Rent Adjustment Deposit representing Tenant’s Share of Operating Expenses for the applicable calendar year (or partial calendar year), monthly during the Term with the payment of Monthly Base Rent;

(b) The Rent Adjustment Deposit representing Tenant’s Share of Taxes for the applicable calendar year (or partial calendar year), monthly during the Term with the payment of Monthly Base Rent;

(c) Any Rent Adjustments due in excess of the Rent Adjustment Deposits in accordance with Section 4.2. Rent Adjustments due from Tenant to Landlord for any calendar year (or partial calendar year) shall be Tenant’s Share of Operating Expenses for such calendar year (or partial calendar year) and Tenant’s Share of Taxes for such calendar year (or partial calendar year); and

(d) For purposes of determining Rent Adjustments, if the Building or Property is not fully occupied during all or a portion of any calendar year during the Term, Landlord shall make appropriate adjustments to the variable components of Operating Expenses for such calendar year (or partial calendar year), employing sound accounting and management principles consistently applied, to determine the amount of Operating Expenses that would have been paid or incurred by Landlord had the Building or Property been ninety-five percent (95%) occupied, and the amount so determined shall be deemed to have been the amount of Operating Expenses for such calendar year (or partial calendar year).

4.2 STATEMENT OF LANDLORD

Landlord shall use commercially reasonably efforts to furnish to Tenant, within 120 days following the expiration of each calendar year (but in any event as soon as feasible after the expiration of each calendar year), a statement (“Landlord’s Statement”) showing the following:

(a) Operating Expenses and Taxes for such calendar year;

(b) The amount of Rent Adjustments due Landlord for the last calendar year, less credit for Rent Adjustment Deposits paid, if any; and

(c) Any change in the Rent Adjustment Deposit due monthly in the current calendar year, including the amount or revised amount due for months preceding any such change pursuant to Landlord’s Statement.

Tenant shall pay to Landlord within thirty (30) days after receipt of such statement any amounts for Rent Adjustments then due in accordance with Landlord’s Statement. Any amounts due from Landlord to Tenant pursuant to this Section shall be credited to the Rent Adjustment Deposit next coming due, or refunded to Tenant within thirty (30) days after such determination if the Term has already expired, provided Tenant is not in default hereunder beyond any applicable notice and cure period. No interest or penalties shall accrue on any amounts that Landlord is obligated to credit or refund to Tenant by reason of this Section 4.2. Landlord’s failure to deliver Landlord’s Statement or to compute the amount of the Rent Adjustments shall not constitute a waiver by Landlord of its right to deliver such items nor constitute a waiver or release of Tenant’s obligations to pay such amounts. The Rent Adjustment Deposit shall be credited against Rent Adjustments due for the applicable calendar year (or partial calendar year). During the last complete calendar year or during any partial calendar year in which the Lease terminates, Landlord may include in the Rent Adjustment Deposit its good faith estimate of Rent Adjustments which may not be finally determined until after the termination of this Lease. Landlord’s and Tenant’s obligation respecting Rent Adjustments shall survive the expiration or termination of this Lease. Notwithstanding the foregoing, in no event shall the sum of Monthly Base Rent and the Rent Adjustments be less than the Monthly Base Rent payable.

4.3 BOOKS AND RECORDS

Landlord shall maintain books and records showing Operating Expenses and Taxes in accordance with sound accounting and management practices, consistently applied. Tenant or its representative (which representative shall be a certified public accountant licensed to do business in the state in which the Property is located and whose primary business is certified public accounting and who shall not be paid on a contingency basis) shall have the right, for a period of two hundred seventy (270) days following the date upon which Landlord’s Statement is delivered to Tenant, to examine the Landlord’s books and records with respect to the items in the foregoing statement of Operating Expenses and Taxes during normal business hours, upon written notice, delivered at least three (3) business days in advance. If Tenant does not object in writing to Landlord’s Statement within two hundred seventy (270) days of Tenant’s receipt thereof, specifying the nature of the item in dispute and the reasons therefor, then Landlord’s Statement shall be considered final and accepted by Tenant and Tenant shall be deemed to have waived its right to dispute Landlord’s Statement. If Tenant does dispute any Landlord’s Statement, Tenant shall deliver a copy of any such audit to Landlord at the time of notification of the dispute. If Tenant does not provide such notice of dispute and a copy of such audit to Landlord within such two hundred seventy (270) day period, it shall be deemed to have waived such right to dispute Landlord’s Statement. Any amount due to the Landlord as shown on Landlord’s Statement, whether or not disputed by Tenant as provided herein shall be paid by Tenant when due as provided above, without prejudice to any such written exception. In no event shall Tenant be permitted to examine Landlord’s records or to dispute any statement of Operating Expenses and Taxes unless Tenant has paid and continues to pay all Rent when due. If Landlord disagrees with the results of Tenant’s review of Landlord’s Statement, a certification as to the proper amount shall be made in accordance with generally accepted accounting practices by an independent certified public accountant selected by Landlord and who is a member of a nationally or regionally recognized accounting firm (“Landlord’s Accountant”). Landlord’s Accountant shall complete its review and certify such result to Landlord and Tenant within ninety (90) days following the date Tenant disputed the items in Landlord’s Statement. Upon resolution of any dispute with respect to Operating Expenses and Taxes pursuant to this Section 4.3, Tenant shall either pay Landlord any shortfall or Landlord shall credit Tenant with respect to any overages paid by Tenant against Tenant’s next Rent Adjustments coming due. In the event it is determined pursuant to this Section 4.3 that Landlord’s Statement overstated the amount of Operating Expenses and Taxes by eight percent (8%) or more, then Landlord shall reimburse Tenant for its actual and reasonable out-of-pocket audit expenses, not to exceed eight thousand five hundred dollars ($8,500.00) and Landlord shall be responsible for the costs of Landlord’s Accountant. The records obtained by Tenant shall be treated as confidential and neither Tenant nor any of its representatives or agents shall disclose or discuss the information set forth in the audit to or with any other person or entity (“Confidentiality Requirement”) except (a) to Tenant’s attorneys, accountants and consultants as reasonably necessary or (b) to the extent required by applicable laws or court order. Tenant shall indemnify and hold Landlord harmless for any losses or damages arising out of the breach of the Confidentiality Requirement.

4.4 TENANT OR LEASE SPECIFIC TAXES

In addition to Monthly Base Rent, Rent Adjustments, Rent Adjustment Deposits and other charges to be paid by Tenant, Tenant shall pay to Landlord, upon demand, any and all taxes payable by Landlord (other than the Prohibited Taxes) whether or not now customary or within the contemplation of the parties hereto: (a) upon, allocable to, or measured by the Rent payable hereunder, including any gross receipts tax or excise tax levied by any governmental or taxing body with respect to the receipt of such rent; or (b) upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion thereof; or (c) upon the measured value of Tenant’s personal property located in or about the Premises or in any storeroom or any other place in or about the Premises, it being the intention of Landlord and Tenant that, to the extent possible, such personal property taxes shall be billed to and paid directly by Tenant; (d) resulting from any Tenant Alterations; or (e) upon this transaction. Taxes paid by Tenant pursuant to this Section 4.4 shall not be included in any computation of Taxes payable pursuant to Sections 4.1 and 4.2.

ARTICLE 5

SECURITY DEPOSIT

Landlord acknowledges that it currently holds a security deposit under the Prior Lease (the “Existing Deposit”), which the parties agree is currently Eleven Thousand Nine Hundred Thirty-Six and 96/100 Dollars ($11,936.96). Concurrent with its execution of this Lease, Tenant shall deliver to Landlord, . in immediately available funds, an amount equal to the difference between the Existing Deposit and the amount of the Security Deposit required by Section 1.1(10) above. Tenant acknowledges and agrees that the Existing Deposit shall be available to Landlord as part of the Security Deposit required under this Lease and that upon the expiration or earlier termination of the Prior Lease, the Existing Deposit shall be retained by Landlord in partial satisfaction of the Security Deposit required hereunder. The Security Deposit may be applied by Landlord to cure, in whole or part, any default of Tenant under this Lease, and upon notice by Landlord of such application, Tenant shall replenish the Security Deposit in full by paying to Landlord within ten (10) days of demand the amount so applied. Landlord’s application of the Security Deposit shall not constitute a waiver of Tenant’s default to the extent that the Security Deposit does not fully compensate Landlord for all losses, damages, costs and expenses incurred by Landlord in connection with such default and shall not prejudice any other rights or remedies available to Landlord under this Lease or by Law. Landlord shall not pay any interest on the Security Deposit. Landlord shall not be required to keep the Security Deposit separate from its general accounts. The Security Deposit shall not be deemed an advance payment of Rent or a measure of damages for any default by Tenant under this Lease, nor shall it be a bar or defense of any action that Landlord may at any time commence against Tenant. In the absence of evidence satisfactory to Landlord of an assignment of the right to receive the Security Deposit or the remaining balance thereof, Landlord may return the Security Deposit to the original Tenant. regardless of one or more assignments of this Lease. Upon the transfer of Landlord’s interest under this Lease, Landlord’s obligation to Tenant with respect to the Security Deposit shall terminate upon transfer to the transferee of the Security Deposit, or any balance thereof. If Tenant shall fully and faithfully comply with all the terms, provisions, covenants, and conditions of this Lease, the Security Deposit, or any balance thereof, shall be returned to Tenant within thirty (30) days after Landlord recovers possession of the Premises. Tenant hereby waives any and all rights of Tenant under the provisions of Section 1950.7 of the California Civil Code or other Law regarding security deposits.

ARTICLE 6

UTILITIES AND SIGNAGE

6.1 UTILITIES GENERALLY

(a) Tenant pay for the cost of all services and utilities billed or metered separately to the Premises, including, but not limited to heating, ventilation and air conditioning, electricity, water, telephone, janitorial and interior Building security services, together with all taxes, assessments, charges and penalties added to or included within such cost.

(b) In the event the Premises are not separately metered for any given utility, Landlord may in its sole discretion either (i) install one or more meters to measure the consumption of such utility at the Premises or (ii) reasonably estimate the consumption of such utility at the Premises. Upon notice from Landlord, Tenant shall pay Landlord the cost of installing and maintaining all such meters or submeters and of any engineering or consulting firm, if Landlord retains such firm to estimate the utility current furnished to the Premises in lieu of installation of a meter.

(c) If Tenant uses heat generating machines or equipment in the Premises to an extent which adversely affects the temperature otherwise maintained by the air-cooling system or whenever the occupancy or electrical load adversely affects the temperature otherwise maintained by the air-cooling system, Landlord reserves the right to install or to require Tenant to install supplementary air-conditioning units in the Premises. Tenant shall bear all costs and expenses related to the installation, maintenance and operation of such units.

(d) Landlord shall not provide janitorial services for the interior of the Building. Tenant shall be solely responsible for performing all janitorial services and other cleaning of the Premises, all in compliance with applicable Laws.

6.2 INTERRUPTION OF USE

Except as otherwise provided in this Lease, Tenant agrees that Landlord shall not be liable for damages, by abatement of Rent or otherwise, for any failure or interruption of utilities or services to the Project, or for any diminution in the quality or quantity thereof, for any reason whatsoever, including without limitation when occasioned, in whole or in part, by breakage, repairs, replacements, or improvements, by any strike, lockout or other labor trouble, by inability to secure electricity, gas, water, or other fuel at the Building or Project, by any riot or other dangerous condition, emergency, accident or casualty whatsoever; and such failures or delays or diminution shall never be deemed to constitute an eviction or disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease. Furthermore, Landlord shall not be liable under any circumstances for a loss of, or injury to, property or for injury to, or interference with, Tenant’s business, including, without limitation, loss of profits, however occurring. Notwithstanding the foregoing, if the Premises is made untenantable, inaccessible or unsuitable for the ordinary conduct of Tenant’s business, due to an interruption in access to the Premises or any of the utilities or services provided by Landlord as a result of Landlord’s negligence or willful misconduct, then (i) Landlord shall use commercially reasonable good faith efforts to restore the same as soon as is reasonably possible, (ii) if, despite such commercially reasonable good faith efforts by Landlord, such interruption persists for a period in excess of three (3) consecutive business days, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent and Rent Adjustments payable hereunder during the period beginning on the fourth (4th) consecutive business day of such interruption and ending on the day the utility or service has been restored.

6.3 SIGNAGE

(a) Provided Tenant is not in Default under this Lease, Tenant shall have the right, but not the obligation, at Tenant’s sole cost and expense, to install either an eyebrow or a building top sign on the exterior of the Building (“Tenant’s Signage”). Tenant’s Signage shall be subject to Landlord’s reasonable approval as to size, design, exact location, graphics, materials, colors and similar specifications and shall be consistent with the exterior design, materials and appearance of the Project and the Project’s signage program (if any) and shall be further subject to all applicable local governmental laws, rules, regulations, codes and Tenant’s receipt of all permits and other governmental approvals and any applicable covenants, conditions and restrictions. The cost to maintain and operate, if any, Tenant’s Signage shall be paid for by Tenant. Upon the expiration of the Term, or other earlier termination of this Lease, Tenant shall be responsible for any and all costs associated with the removal of Tenant’s Signage, including, but not limited to, the cost to repair and restore the area impacted by Tenant’s Signage to its original condition, normal wear and tear excepted.

(b) Subject to the terms of Section 6.3(a) above, Tenant shall not place or permit to be placed in, upon, or about the Premises, the Building or the Project any exterior lights, decorations, balloons, flags, pennants, banners, advertisements or notices, or erect or install any signs, windows or door lettering, placards, decorations, or advertising media of any type which can be viewed from the exterior of the Premises without obtaining Landlord’s prior written consent, which shall not be unreasonably withheld or delayed. Tenant shall remove any sign, advertisement or notice placed on the Premises, the Building or the Project by Tenant upon the expiration of the Term or sooner termination of this Lease, and Tenant shall repair any damage or injury to the Premises, the Building or the Project caused thereby, all at Tenant’s expense. If any signs are not removed, or necessary repairs not made, Landlord shall have the right to remove the signs and repair any damage or injury to the Premises, the Building or the Project caused by such installation or removal at Tenant’s sole cost and expense.

ARTICLE 7

POSSESSION, USE AND CONDITION OF PREMISES

7.1 POSSESSION AND USE OF PREMISES

(a) Tenant shall occupy and use the Premises only for the uses specified in Section 1.1(11) to conduct Tenant’s business. Tenant shall not occupy or use the Premises (or permit the use or occupancy of the Premises) for any purpose or in any manner which: (1) is unlawful or in violation of any Law or Environmental Law; (2) may be dangerous to persons or property or which may increase the cost of, or invalidate, any policy of insurance carried on the Building or covering its operations; (3) is contrary to or prohibited by the terms and conditions of this Lease or the rules of the Building set forth in Article 18; or (4) would tend to create or continue a nuisance.

(b) Landlord and Tenant acknowledge that the Americans With Disabilities Act of 1990 (42 U.S.C. §12101 et seq.) and regulations and guidelines promulgated thereunder, as all of the same may be amended and supplemented from time to time (collectively referred to herein as the “ADA”) establish requirements for business operations, accessibility and barrier removal, and that such requirements may or may not apply to the Premises, the Building and the Project depending on, among other things: (1) whether Tenant’s business is deemed a “public accommodation” or “commercial facility”, (2) whether such requirements are “readily achievable”, and (3) whether a given alteration affects a “primary function area” or triggers “path of travel” requirements. The parties hereby agree that: (a) Landlord shall be responsible , as part of Operating Expenses (to the extent permitted to be included in Operating Expenses pursuant to the definition of Operating Expenses in Section 1.03 above), for ADA Title III compliance in the Common Areas, except as provided below, (b) Tenant shall be responsible for ADA Title III compliance in the Premises, including any leasehold improvements or other work to be performed in the Premises under or in connection with this Lease, (c) Landlord may perform, or require that Tenant perform, and Tenant shall be responsible for the cost of, ADA Title III “path of travel” requirements triggered by Tenant Alterations in the Premises, and (d) Landlord may perform, or require Tenant to perform, and Tenant shall be responsible for the cost of, ADA Title III compliance in the Common Areas necessitated by the Building being deemed to be a “public accommodation” instead of a “commercial facility” as a result of Tenant’s specific use of the Premises. Tenant shall be solely responsible for requirements under Title I of the ADA relating to Tenant’s employees.

(c) Hazardous Materials.

(1) Definitions. The following terms shall have the following meanings for purposes of this Lease:

(i) “Biohazardous Materials” means any and all substances and materials defined or referred to as “medical waste,” “biological waste,” “biohazardous waste,” “biohazardous material” or any other term of similar import under any Hazardous Materials Laws, including (but not limited to) California Health & Safety Code Sections 25100 et seq., and any regulations promulgated thereunder, as amended from time to time.

(ii) “Environmental Condition” means the Release of any Hazardous Materials in, over, on, under, through, from or about the Project (including, but not limited to, the Premises).

(iii) “Environmental Damages” means all claims, suits, judgments, damages, losses, penalties, fines, liabilities, encumbrances, liens, costs and expenses of whatever kind or nature, contingent or otherwise, matured or unmatured, foreseeable or unforeseeable, arising out of or in connection with any Environmental Condition, including, to the extent arising out of an Environmental Condition, without limitation: (A) damages for personal injury, or for injury or damage to the Project or natural resources occurring on or off the Project, including without limitation (1) any claims brought by or on behalf of any person, (2) any loss of, lost use of, damage to or diminution in value of any Project or natural resource, and (3) costs of any investigation, remediation, removal, abatement, containment, closure, restoration or monitoring work required by any federal, state or local governmental agency or political subdivision, or otherwise reasonably necessary to protect the public health or safety, whether on or off the Project; (B) reasonable fees incurred for the services of attorneys, consultants, contractors, experts and laboratories in connection with the preparation of any feasibility studies, investigations or reports or the performance of any work described above; (C) any liability to any third person or governmental agency to indemnify such person or agency for costs expended or liabilities incurred in connection with any items described in clause (A) or (B) above; (D) any fair market or fair market rental value of the Project; and (E) the amount of any penalties, damages or costs a party is required to pay or incur in excess of that which the party otherwise would reasonably have expected to pay or incur absent the existence of the applicable Environmental Condition.

(iv) “Handling” or “Handles”, when used with reference to any substance or material, includes (but is not limited to) any receipt, storage, use, generation, Release, transportation, treatment or disposal of such substance or material.

(v) “Hazardous Materials” means any and all chemical, explosive, biohazardous, radioactive or otherwise toxic or hazardous materials or hazardous wastes, including without limitation any asbestos-containing materials, PCB’s, CFCs, petroleum and derivatives thereof, Radioactive Materials, Biohazardous Materials, Hazardous Wastes, any other substances defined or listed as or meeting the characteristics of a hazardous substance, hazardous material, Hazardous Waste, toxic substance, toxic waste, biohazardous material, biohazardous waste, biological waste, medical waste, radiation, radioactive substance, radioactive waste, or other similar term, as applicable, under any law, statute, ordinance, code, rule, regulation, directive, order, condition or other written requirement enacted, promulgated or issued by any public officer or governmental or quasi-governmental authority, whether now in force or hereafter in force at any time or from time to time to protect the environment or human health, and/or any mixed materials, substances or wastes containing more than one of the foregoing categories of materials, substances or wastes.

(vi) “Hazardous Materials Laws” means, collectively, (A) the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. Sections 9601-9657, (B) the Hazardous Materials Transportation Act of 1975, 49 U.S.C. Sections 5101-5128 (formerly 1801-1812), (C) the Resource Conservation and Recovery Act of 1976, 42 U.S.C. Sections 6901-6987 (together with any amendments thereto, any regulations thereunder and any amendments to any such regulations as in effect from time to time, “RCRA”), (D) the California Carpenter-Presley-Tanner Hazardous Substance Account Act, California Health & Safety Code Sections 25300 et seq., (E) the Hazardous Materials Release Response Plans and Inventory Act, California Health & Safety Code Sections 25500 et seq., (F) the California Hazardous Waste Control Law, California Health & Safety Code Sections 25100 et seq. (together with any amendments thereto, any regulations thereunder and any amendments to any such regulations as in effect from time to time, the “CHWCL”), (G) California Health & Safety Code Sections 25015 et seq., (H) any amendments to or successor statutes to any of the foregoing, as adopted or enacted from time to time, (I) any regulations or amendments thereto promulgated pursuant to any of the foregoing from time to time, (J) any Laws relating to Biohazardous Materials, including (but not limited to) any regulations or requirements with respect to the shipping, use, decontamination and disposal thereof, and (K) any other Law now or at any time hereafter in effect regulating, relating to or imposing liability or standards of conduct concerning any Hazardous Materials, including (but not limited to) any requirements or conditions imposed pursuant to the terms of any orders, permits, licenses, registrations or operating plans issued or approved by any governmental or quasi-governmental authority from time to time either on a Project-wide basis or in connection with any Handling of Hazardous Materials in, on or about the Premises or the Project.

(vii) “Hazardous Wastes” means (A) any waste listed as or meeting the identified characteristics of a “hazardous waste” or terms of similar import under RCRA, (B) any waste meeting the identified characteristics of a “hazardous waste”, “extremely hazardous waste” or “restricted hazardous waste” under the CHWCL, and/or (C) any and all other substances and materials defined or referred to as a “hazardous waste” or other term of similar import under any Hazardous Materials Laws.

(viii) “Radioactive Materials” means (A) any and all substances and materials the Handling of which requires an approval, consent, permit or license from the Nuclear Regulatory Commission, (B) any and all substances and materials the Handling of which requires a Radioactive Material License or other similar approval, consent, permit or license from the State of California, and (C) any and all other substances and materials defined or referred to as “radiation,” a “radioactive material” or “radioactive waste,” or any other term of similar import under any Hazardous Materials Laws, including (but not limited to) Title 26, California Code of Regulations Section 17-30100, and any statutes, regulations or other laws administered, enforced or promulgated by the Nuclear Regulatory Commission.

(ix) “Release” means any accidental or intentional spilling, leaking, pumping, pouring, emitting, discharging, injecting, escaping, leaching, migrating, dumping or disposing into the air, land, surface water, groundwater or the environment (including without limitation the abandonment or discarding of receptacles containing any Hazardous Materials).

(x) “Tenant’s Contamination” means any Hazardous Material Release on or about the Property by Tenant and/or any agents, employees, contractors, vendors, suppliers, licensees, subtenants, and visitors of Tenant (a “Tenant Party”).

(xi) “Landlord’s Contamination” means any Hazardous Materials (A) which exist in, on, under or in the vicinity of the Project as of the date of this Lease not caused by Tenant, (B) which migrate onto or beneath the Project after termination of the Lease, or (C) introduced by Landlord or its agents, employees, contractors, vendors or suppliers. Tenant shall not be required to pay any costs with respect to the remediation or abatement of Landlord’s Contamination.

(2) Handling of Hazardous Materials. The parties acknowledge that Tenant wishes and intends to use all or a portion of the Premises as a bio-pharmaceutical warehouse and dispensing facility and otherwise for the conduct by Tenant of its business in accordance with the use specified in Section 1.1(12), that such use, as conducted or proposed to be conducted by Tenant, would customarily include the Handling of Hazardous Materials, and that Tenant shall therefore be permitted to engage in the Handling in the Premises of necessary and reasonable quantities of Hazardous Materials customarily used in or incidental to the operation of a bio pharmaceutical warehouse and dispensing facility and the other business operations of Tenant in the manner conducted or proposed to be conducted by Tenant hereunder (“Permitted Hazardous Materials”), provided that the Handling of such Permitted Hazardous Materials by all Tenant Parties shall at all times comply with and be subject to all provisions of this Lease and all Laws, including all Hazardous Materials Laws. Without limiting the generality of the foregoing, Tenant shall comply at all times with all Hazardous Materials Laws applicable to any aspect of Tenant’s use of the Premises and the Project and of Tenant’s operations and activities in, on and about the Premises and the Project, and shall ensure at all times that Tenant’s Handling of Hazardous Materials in, on and about the Premises does not violate (x) the terms of any governmental licenses or permits applicable to the Building (including, but not limited to, the Building Discharge Permit as defined below) or Premises or to Tenant’s Handling of any Hazardous Materials therein, or (y) any applicable requirements or restrictions relating to the occupancy classification of the Building and the Premises.

(3) Disposition or Emission of Hazardous Materials. Tenant shall not Release or dispose of any Hazardous Materials, except to the extent authorized by permit, at the Premises or on the Project, but instead shall arrange for off-site disposal, under Tenant’s own name and EPA waste generator number (or other similar identifying information issued or prescribed by any other governmental authority with respect to Radioactive Materials, Biohazardous Materials or any other Hazardous Materials) and at Tenant’s sole expense, in compliance with all applicable Hazardous Materials Laws, with the Laboratory Rules and Regulations (defined below) and with all other applicable Laws and regulatory requirements.

(4) Information Regarding Hazardous Materials. Tenant shall provide the following information and/or documentation to Landlord in writing prior to the Commencement Date, and thereafter shall update and deliver to Landlord such information and/or documentation (x) annually, by no later than the date required by law, (y) upon any material change in Tenant’s Hazardous Materials inventory or in Tenant’s business operations involving Hazardous Materials, and (z) at such other times as Landlord may reasonably request in writing from time to time, which updates shall reflect any material changes in such information and/or documentation:

(i) An inventory of all Hazardous Materials that Tenant receives, uses, handles, generates, transports, stores, treats or disposes of from time to time, or at the time of preparation of such inventory proposes or expects to use, handle, generate, transport, store, treat or dispose of from time to time, in connection with its operations at the Premises. Such inventory shall include, but shall separately identify, any Hazardous Wastes, Biohazardous Materials and Radioactive Materials covered by the foregoing description. If such inventory includes any Biohazardous Materials, Tenant shall also disclose in writing to Landlord the Biosafety Level designation associated with the use of such materials.

(ii) Copies of all then existing permits, licenses, registrations and other similar documents issued by any governmental or quasi-governmental authority that authorize any Handling of Hazardous Materials in, on or about the Premises or the Project by any Tenant Party.

(iii) All Material Safety Data Sheets (“MSDSs”), if any, required to be completed with respect to operations of Tenant at the Premises from time to time in accordance with Title 26, California Code of Regulations Section 8-5194 or 42 U.S.C. Section 11021, or any amendments thereto, and any Hazardous Materials Inventory Sheets that detail the MSDSs. As of the Date of this Lease, all Tenant’s current MSDSs are on file at 2910 Seventh Street, Berkeley, California 94710, and are available for review and copy by Landlord upon request.

(iv) All hazardous waste manifests (as defined in Title 26, California Code of Regulations Section 22-66481), if any, that Tenant is required to complete from time to time in connection with its operations at the Premises. As of the Date of this Lease, all Tenant’s current hazardous waste manifests are on file at 2910 Seventh Street, Berkeley, California 94710, and are available for review and copy by Landlord upon request.

(v) A copy of any “Hazardous Materials Business Plan” required from time to time with respect to Tenant’s operations at the Premises pursuant to California Health & Safety Code Sections 25500 et seq., and any regulations promulgated thereunder, as amended from time to time, or in connection with Tenant’s application for a business license from the City of Emeryville. If applicable law does not require Tenant to prepare a Hazardous Materials Business Plan, Tenant shall furnish to Landlord at the times and in the manner set forth above the information that would customarily be contained in a Hazardous Materials Business Plan, including (but not limited to) information regarding Tenant’s Hazardous Materials inventories. The parties acknowledge that a Hazardous Materials Business Plan would ordinarily include an emergency response plan, and that regardless of whether applicable Law requires Tenant or other tenants in the Building to prepare Hazardous Materials Business Plans, Landlord in its discretion may elect to prepare a coordinated emergency response plan for the entire Building and/or for multiple Buildings on or about the Project.

(vi) Any “Contingency Plans and Emergency Procedures” required of Tenant from time to time, in connection with its operations at the Premises, pursuant to applicable Law, Title 26, California Code of Regulations Sections 22-67140 et seq., and any amendments thereto, and any “Training Programs and Records” required under Title 26, California Code of Regulations Section 22-66493, and any amendments thereto from time to time. Landlord in its discretion may elect to prepare a Contingency Plan and Emergency Procedures for the entire Building and/or for multiple Buildings on the Project, in which event, if applicable law does not require Tenant to prepare a Contingency Plan and Emergency Procedures for its operations at the Premises, Tenant shall furnish to Landlord at the times and in the manner set forth above the information that would customarily be contained in a Contingency Plan and Emergency Procedures.

(vii) Copies of any biennial or other periodic reports furnished or required to be furnished to the California Department of Health Services from time to time, under applicable law, pursuant to Title 26, California Code of Regulations Section 22-66493 and any amendments thereto, relating to any Hazardous Materials.

(viii) Copies of any industrial wastewater discharge permits issued to or held by Tenant from time to time in connection with its operations at the Premises (the parties presently anticipate, however, that because of the existence of the Building Discharge Permit in Landlord’s name as described above. Tenant will not be required to maintain a separate, individual discharge permit).

(ix) Copies of any other lists, reports, studies, or inventories of Hazardous Materials or of any subcategories of materials included in Hazardous Materials that Tenant is otherwise required to prepare and file from time to time with any governmental or quasi-governmental authority in connection with Tenant’s operations at the Premises, including (but not limited to) reports filed by Tenant with the federal Food & Drug Administration or any other regulatory authorities primarily in connection with the presence (or lack thereof) of any “select agents” or other Biohazardous Materials on the Premises, together with proof of filing thereof.

(x) Any other information reasonably requested by Landlord in writing from time to time in connection with (A) Landlord’s monitoring (in Landlord’s reasonable discretion) and enforcement of Tenant’s obligations under this Section and of compliance with applicable Laws in connection with any Handling or Release of Hazardous Materials in the Premises or Building or on or about the Project by any Tenant Party, (B) any inspections or enforcement actions by any governmental authority pursuant to any Hazardous Materials Laws or any other Laws relating to the presence or Handling of Hazardous Materials in the Premises or Building or on or about the Project by any Tenant Party, and/or (C) Landlord’s preparation (in Landlord’s discretion) and enforcement of any reasonable rules and procedures relating to the presence or Handling by Tenant or any Tenant Party of Hazardous Materials in the Premises or Building or on or about the Project, including (but not limited to) any contingency plans or emergency response plans as described above. Except as otherwise required by Law, Landlord shall keep confidential any information supplied to Landlord by Tenant pursuant to the foregoing, provided, however, that the foregoing shall not apply to any information filed with any governmental authority or available to the public at large. Landlord may provide such information to its lenders, consultants or investors provided such entities agree to keep such information confidential.