Cowen & Company 37th Annual Health Care Conference (Nasdaq: XOMA) March 7, 2017 Exhibit 99.1

Cowen & Company 37th Annual Health Care Conference (Nasdaq: XOMA) March 7, 2017

Forward-looking Statements Certain statements in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding: future monetization opportunities, active transactions with significant financial implications, collaborations poised for significant financial contribution, our library of value-generating assets, future potential for milestone and royalty payments, the potential of our unique antibody discovery engine, potential licensing of compounds in our endocrine asset pipeline, the significant medical need for therapies addressing hyperinsulinemia and the potential for our XOMA 358 asset to meet that need, the further clinical development of 358, the potential for our XOMA 129 asset to provide fast-acting treatment for acute severe hypoglycemia, the prospects for our XOMA 213 asset for treatment of prolactinemia, upcoming internal milestones and value catalysts, our future cash needs, our strategy for value creation, and other statements that relate to future periods. These statements are based on assumptions that may not prove accurate, and actual results could differ materially from those anticipated due to certain risks inherent in the biotechnology industry and for companies engaged in the development of new products in a regulated market. Potential risks to XOMA meeting these expectations are described in more detail in XOMA's most recent filing on Form 10-K and in other SEC filings. Consider such risks carefully when considering XOMA's prospects. Any forward-looking statements represent XOMA’s views only as of the date of this presentation and should not be relied upon as representing its views as of any subsequent date. XOMA disclaims any obligation to update any forward-looking statement, except as required by law.

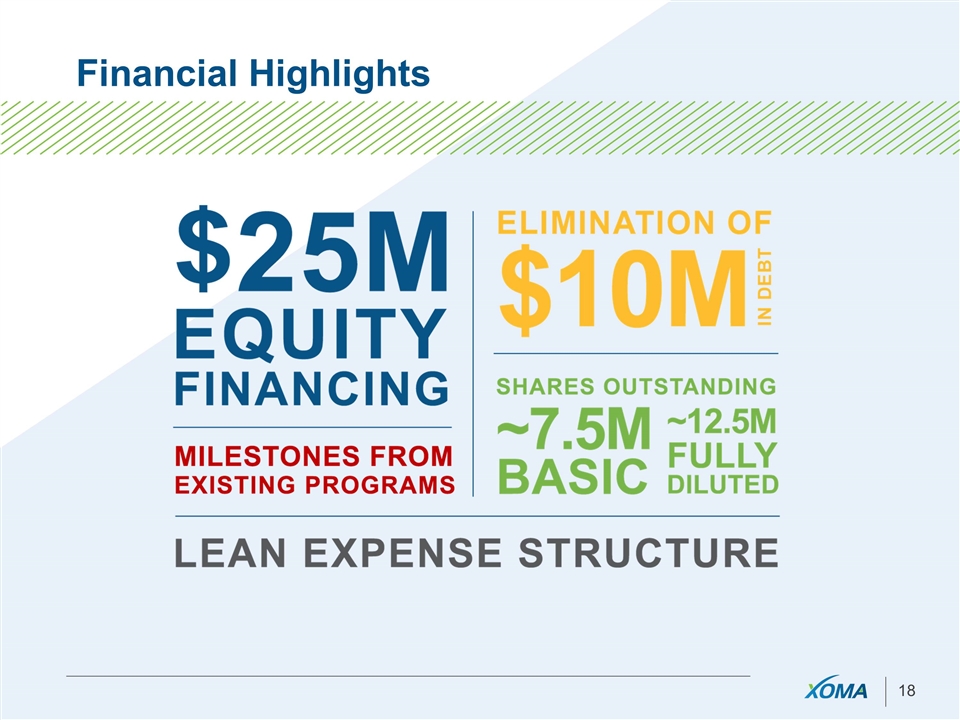

New Focus: What has Changed? New leadership – Jim Neal, CEO Balance sheet re-capped and scrubbed $25 Million BVF Partners investment $10 Million debt eliminated Dramatically reduced cost structure Operating cash burn cut by over 50% Further savings upon X358 licensing Headcount slashed from 180 to < 20 Revenue focus $83 Million in non-dilutive deals in last 18 months

Investment Thesis: Drive Shareholder Value by Combining Revenue from a Portfolio of Partner-Funded Programs with a Lean Cost Structure Extensive portfolio of License Agreements fully funded by partners driving milestones and royalties Over $50M in potential milestones in next 36 months Multiple shots on goal Expand portfolio through out-licensing current programs and acquiring additional programs Including out-license of X358 Expect to be cash flow positive over time Avoid dependence on capital markets BVF investment underscores their belief in the strategy

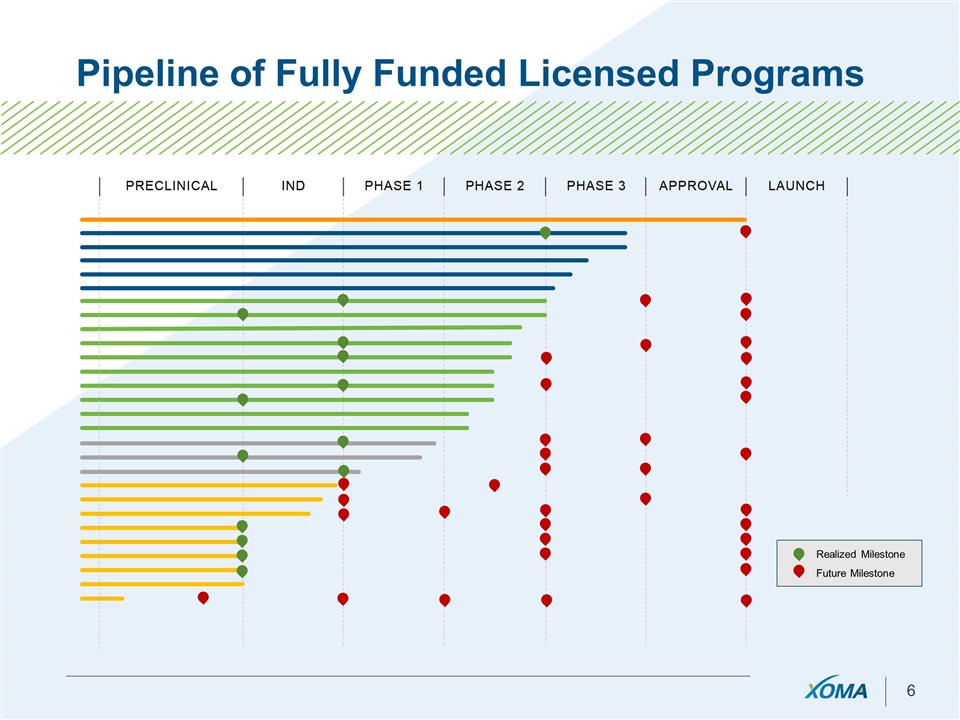

Pipeline of Fully Funded Licensed Programs Realized Milestone Future Milestone

Diverse Portfolio Across Therapeutic Areas ONCOLOGY CNS INFLAMMATION METABOLIC DISEASE BLOOD DISORDERS CARDIOLOGY ANTI-MICROBIAL ANTI-VIRAL

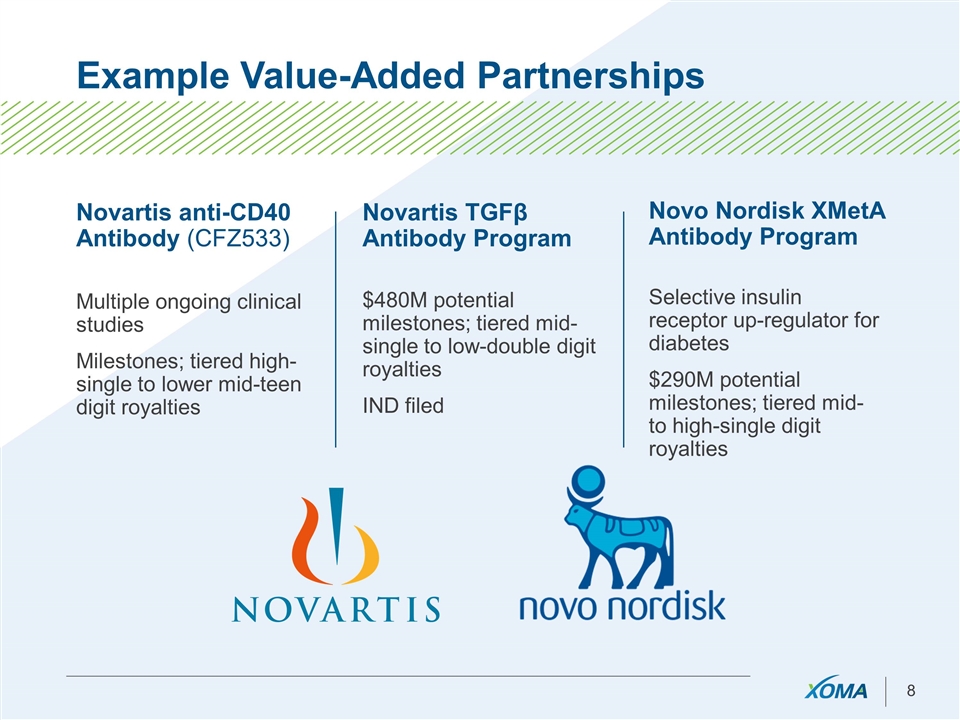

Example Value-Added Partnerships Novartis anti-CD40 Antibody (CFZ533) Multiple ongoing clinical studies Milestones; tiered high-single to lower mid-teen digit royalties Novartis TGFβ Antibody Program $480M potential milestones; tiered mid-single to low-double digit royalties IND filed Novo Nordisk XMetA Antibody Program Selective insulin receptor up-regulator for diabetes $290M potential milestones; tiered mid- to high-single digit royalties

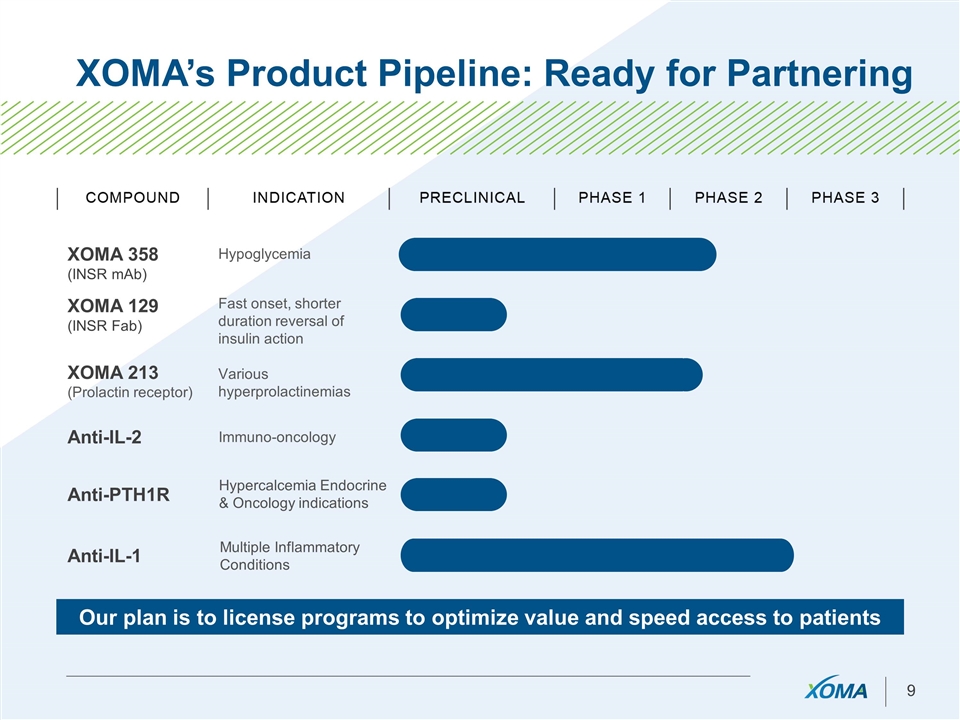

XOMA’s Product Pipeline: Ready for Partnering XOMA 358 (INSR mAb) Hypoglycemia XOMA 129 (INSR Fab) Fast onset, shorter duration reversal of insulin action XOMA 213 (Prolactin receptor) Various hyperprolactinemias Our plan is to license programs to optimize value and speed access to patients Anti-IL-2 Anti-IL-1 Anti-PTH1R Immuno-oncology Multiple Inflammatory Conditions Hypercalcemia Endocrine & Oncology indications

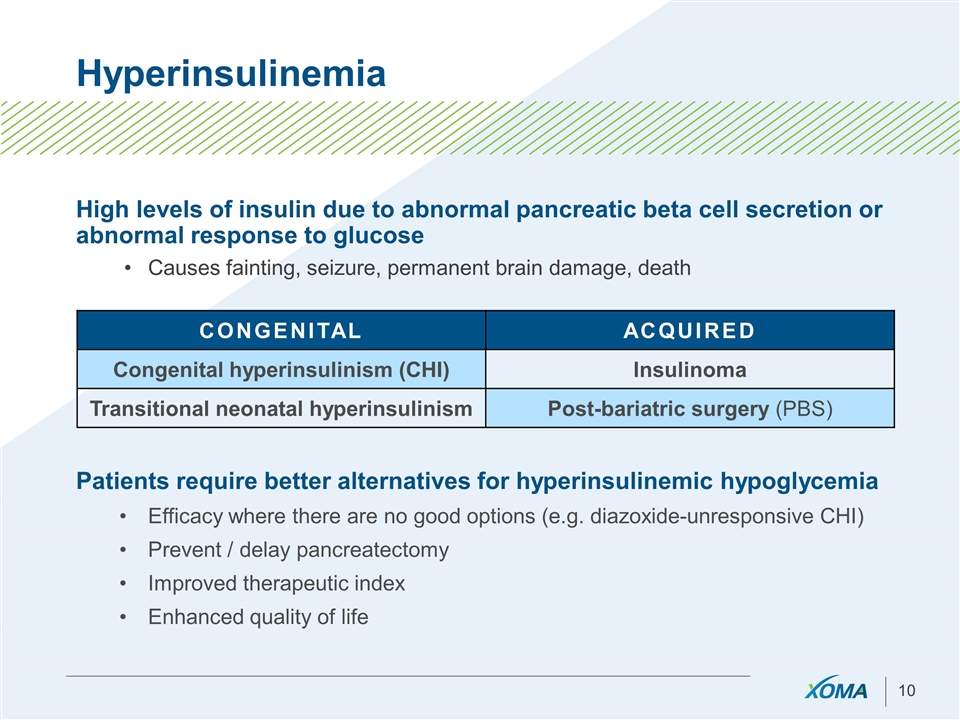

Hyperinsulinemia High levels of insulin due to abnormal pancreatic beta cell secretion or abnormal response to glucose Causes fainting, seizure, permanent brain damage, death CONGENITAL ACQUIRED Congenital hyperinsulinism (CHI) Insulinoma Transitional neonatal hyperinsulinism Post-bariatric surgery (PBS) Patients require better alternatives for hyperinsulinemic hypoglycemia Efficacy where there are no good options (e.g. diazoxide-unresponsive CHI) Prevent / delay pancreatectomy Improved therapeutic index Enhanced quality of life

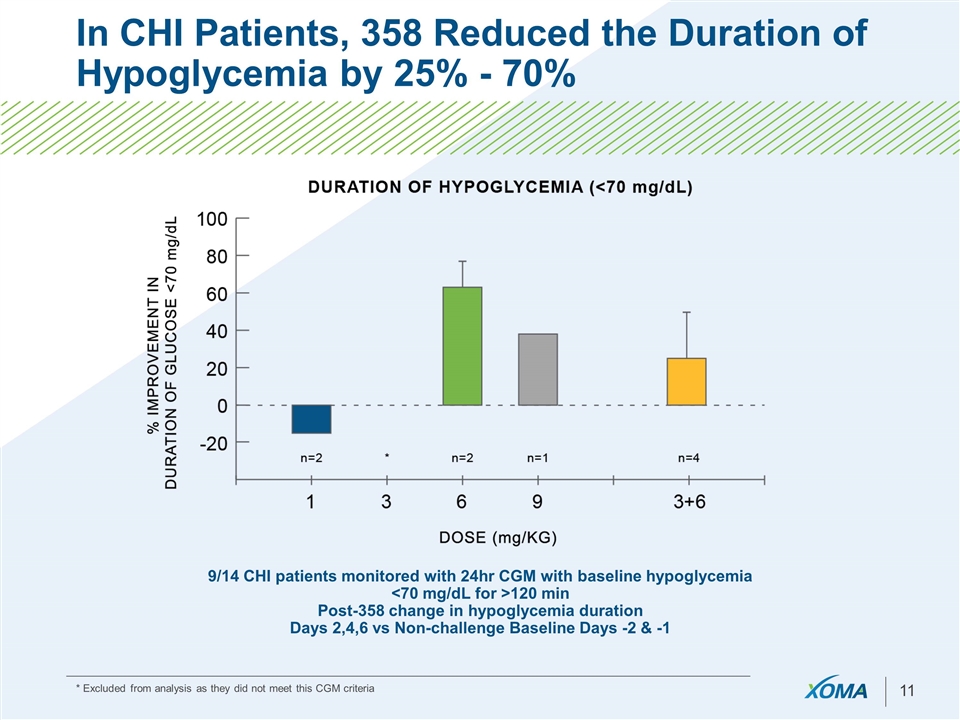

In CHI Patients, 358 Reduced the Duration of Hypoglycemia by 25% - 70% 9/14 CHI patients monitored with 24hr CGM with baseline hypoglycemia <70 mg/dL for >120 min Post-358 change in hypoglycemia duration Days 2,4,6 vs Non-challenge Baseline Days -2 & -1 * Excluded from analysis as they did not meet this CGM criteria

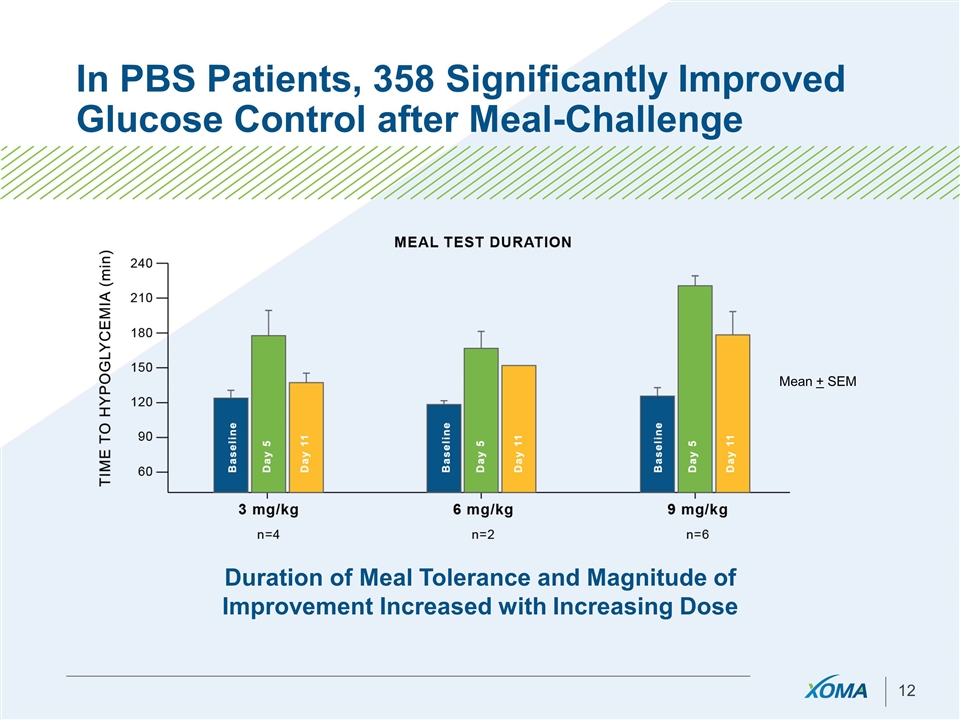

In PBS Patients, 358 Significantly Improved Glucose Control after Meal-Challenge Duration of Meal Tolerance and Magnitude of Improvement Increased with Increasing Dose Mean + SEM

Proof-of-Concept achieved with 358 - Asset is ready for Advancement or Licensure Demonstrated clinically meaningful improvement in glucose levels: Improved AM fasting glucose levels Reduced daily periods of hypoglycemia Improved time to hypoglycemia in meal tests in PBS Correction of nighttime hypoglycemia Majority of patients treated at 3-9 mg/kg doses showed improvement Duration of action ranged 1-2 weeks Additional serum markers affirm attenuated insulin action following 358 treatment in PBS & CHI patients Across all Phase 1 and Phase 2 trials 358 was determined to be generally safe and well tolerated

XOMA 129: Potential Fast-Acting Treatment for Acute Severe Hypoglycemia Highly potent Fab fragment of 358 which down regulates the INSR Offers potential for rapid onset, improved efficacy, and tailored duration of therapy Potential treatment for acute severe hypoglycemia 1. Frier, B. M., G. Schernthaner, and S. R. Heller. "Hypoglycemia and Cardiovascular Risks." Diabetes Care 34, no. Supplement 2 (2011) 2. P. Cryer M.D., Hypoglycemia During Therapy of Diabetes, in DeGroot et al, Endotext, 2015) Hypoglycemia caused by insulin or related therapies remains one of the greatest challenges to glucose management in diabetes2 Bolus Insulin-treated Rat and Minipig models demonstrated: Faster onset of action and improved efficacy over variant mAbs Encouraging potency and duration of efficacy Severe hypoglycemia is life-threatening and has cardiovascular impacts1 ~10% of all ER visits results from insulin-related severe hypoglycemia

XOMA 213 for Prolactinemia: Clinical Proof-of-Mechanism Study is Underway 213 is a fully human, monoclonal antibody against the prolactin receptor Open IND transferred to XOMA from Novartis Significant number of patients treated for potential oncology indications for up to 48 weeks; doses up to 20x higher than expected clinical dose for hyperprolactinemia 1. Dopamine agonist-resistant prolactinomas: J Neurosurg. 2011 May;114(5):1369-79 Prolactinoma – primary indication Benign tumors of the pituitary gland Results in sexual dysfunction, infertility and osteoporosis 10 – 20% of all prolactinomas are either resistant to dopamine agonists or patients cannot tolerate dopamine agonist treatment1 Phase 2 POC study underway Ex-US study in women who wish to suppress lactation immediately postpartum Strategy is to validate inhibition of prolactin mechanism of action

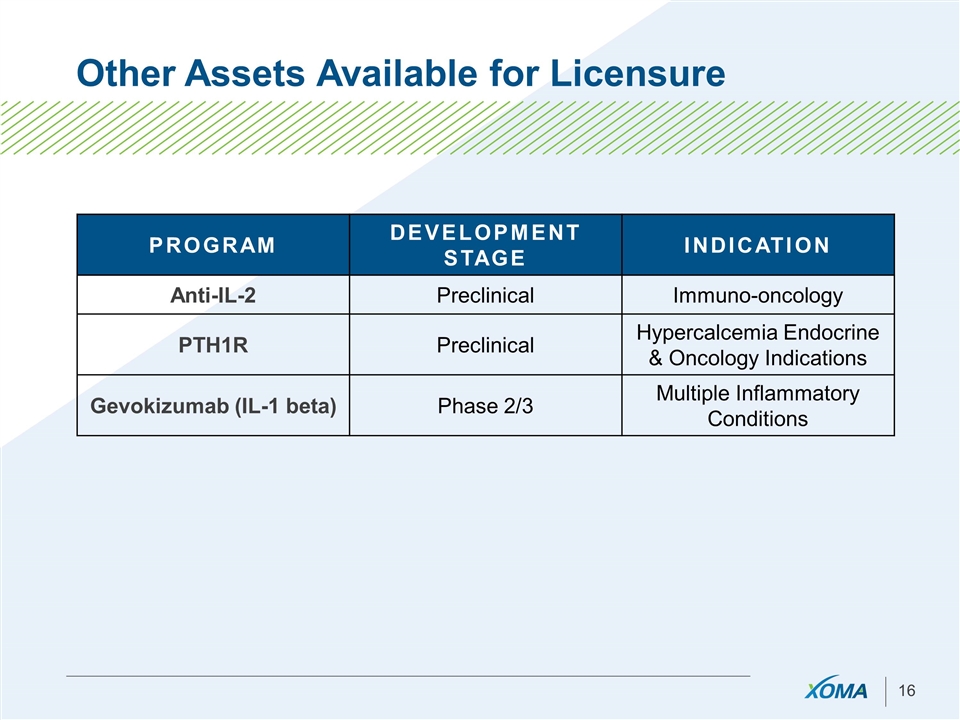

Other Assets Available for Licensure PROGRAM DEVELOPMENT STAGE INDICATION Anti-IL-2 Preclinical Immuno-oncology PTH1R Preclinical Hypercalcemia Endocrine & Oncology Indications Gevokizumab (IL-1 beta) Phase 2/3 Multiple Inflammatory Conditions

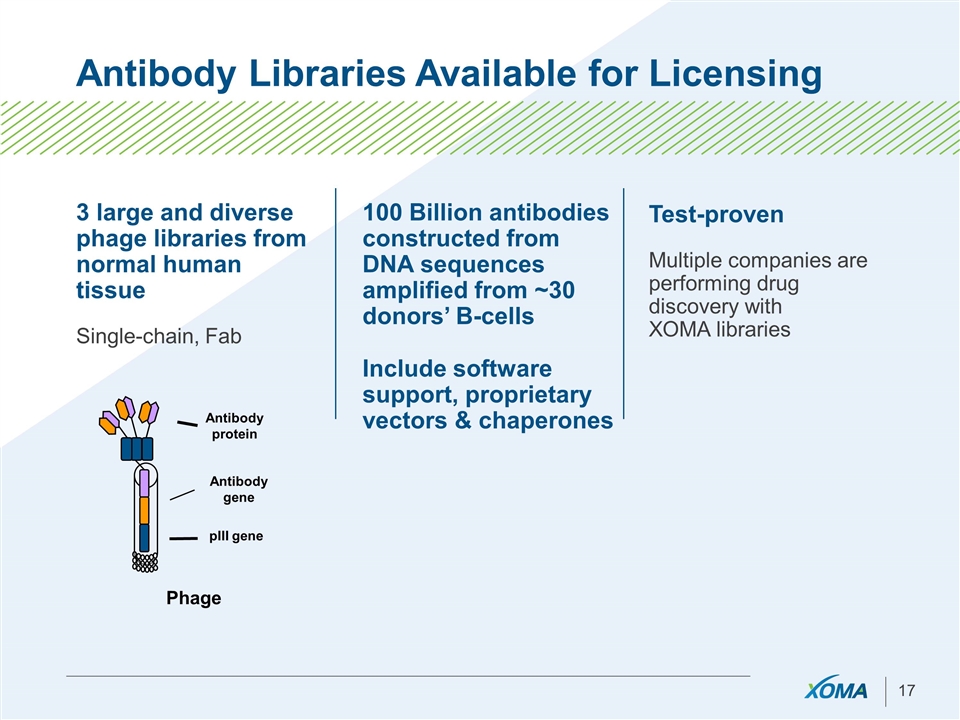

Antibody Libraries Available for Licensing 3 large and diverse phage libraries from normal human tissue Single-chain, Fab 100 Billion antibodies constructed from DNA sequences amplified from ~30 donors’ B-cells Include software support, proprietary vectors & chaperones Test-proven Multiple companies are performing drug discovery with XOMA libraries Antibody protein Antibody gene pIII gene Phage

Financial Highlights

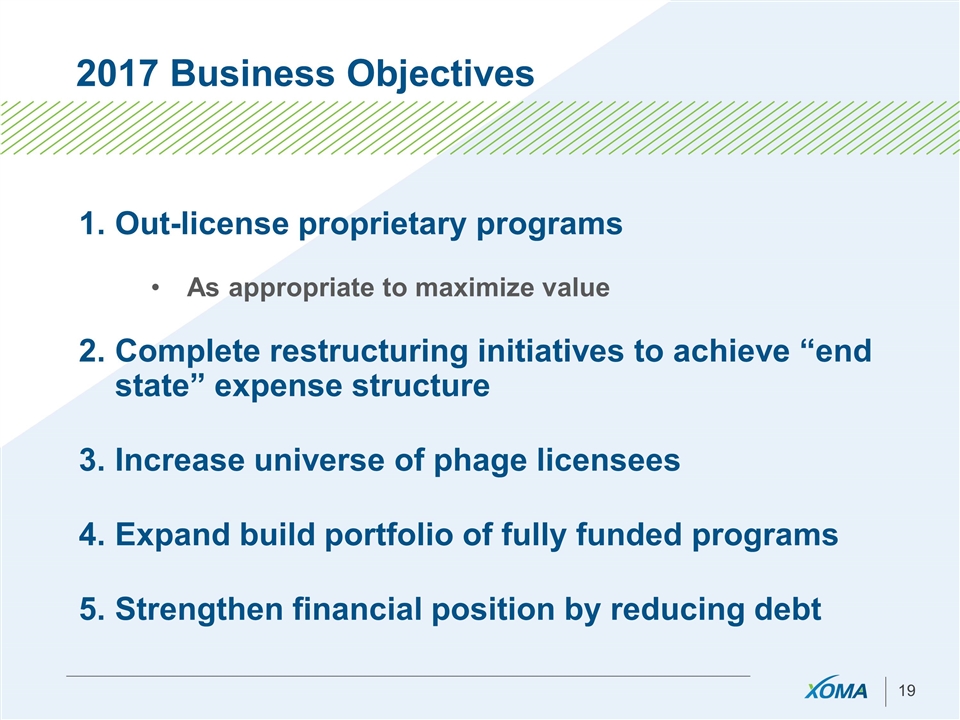

2017 Business Objectives Out-license proprietary programs As appropriate to maximize value Complete restructuring initiatives to achieve “end state” expense structure Increase universe of phage licensees Expand build portfolio of fully funded programs Strengthen financial position by reducing debt

Investment Thesis: Drive Shareholder Value by Combining Revenue from a Portfolio of Partner-Funded Programs with a Lean Cost Structure Extensive portfolio of License Agreements fully funded by partners driving milestones and royalties Over $50M in potential milestones in next 36 months Multiple shots on goal Expand portfolio through out-licensing current programs and acquiring additional programs Including out-license of X358 Expect to be cash flow positive over time Avoid dependence on capital markets BVF investment underscores their belief in the strategy

Cowen & Company 37th Annual Health Care Conference (Nasdaq: XOMA) March 7, 2017