Exhibit 99.1 CORPORATE PRESENTATION THE ROYALTY AGGREGATOR NASDAQ COMMON: XOMA FOR BIOTECH NASDAQ PERPETUAL PREFERRED SHARES: XOMAP, XOMAO COMPANIES JANUARY 2026

DISCLAIMERS Certain statements in this presentation are forward-looking statements XOMA Royalty’s views only as of the date of this presentation and within the meaning of Section 27A of the Securities Act of 1933 and should not be relied upon as representing its views as of any Section 21E of the Securities Exchange Act of 1934, including subsequent date. XOMA Royalty disclaims any obligation to update any statements regarding: future potential monetization opportunities, forward-looking statement, except as required by law. active transactions with significant financial implications, collaborations poised for significant financial contribution, the ability of our partners NOTE: All references to “portfolio” in this presentation are to milestone and their licensees to successfully develop their pipeline programs, the and/or royalty rights associated with a basket of drug products in productivity of acquired assets, our revenue and cashflow forecasts, development. All references to “assets” in this presentation are to upcoming internal milestones and value catalysts, our future cash milestone and/or royalty rights associated with individual drug product needs, our strategy for value creation, and other statements that relate candidates in development. References to royalties or royalty rates to future periods. These statements are not guarantees of future contained herein refer to future potential payment streams regardless performance and undue reliance should not be placed on them. They of whether or not they are technically defined as royalties in the are based on assumptions that may not prove accurate, and actual underlying contractual agreement; further, any rates referenced herein results could differ materially from those anticipated due to certain risks are subject to potential future contractual adjustments. inherent in the biotechnology industry and for companies engaged in the development of new products in a regulated market. Potential risks to XOMA Royalty meeting these expectations are described in more detail in XOMA Royalty's most recent filings on Form 10-K and Form 10-Q. Consider such risks carefully when considering XOMA Royalty's prospects. Any forward-looking statements represent 2

XOMA ROYALTY – WHAT WE DO Royalties Science Milestones Structuring The Biotech Royalty Aggregator 3

XOMA ROYALTY SNAPSHOT: Current Capitalization $ (1) 27.21 / SHARE SHARES (FULLY DILUTED 18.6M TREASURY METHOD) $ ~$ MARKET CAP (FULLY DILUTED) 506M 598M $ 65M PERPETUAL PREFERREDS ENTERPRISE VALUE $ 112M ROYALTY BACKED LOAN $ (2) 85M CASH (1) Share price as of market close 01/07/2026 (2) Cash available to XOMA Royalty as of 09/30/2025 (Reported $130.6M including $85.4M of restricted 4 4 cash. $39.9M of restricted cash was temporarily reserved to fund the Mural Oncology acquisition.)

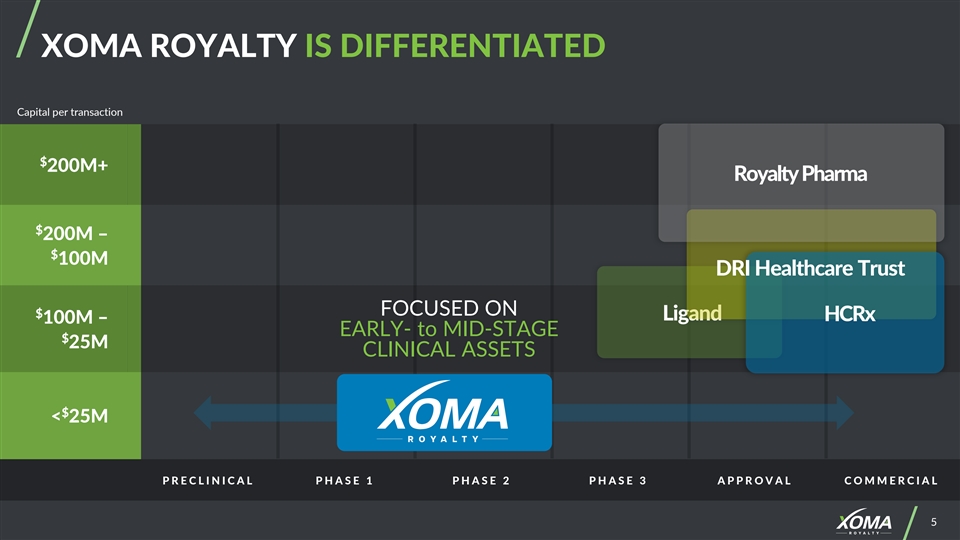

XOMA ROYALTY IS DIFFERENTIATED Capital per transaction $ 200M+ Royalty Pharma $ 200M – $ 100M DRI Healthcare Trust FOCUSED ON $ Ligand HCRx 100M – EARLY- to MID-STAGE $ 25M CLINICAL ASSETS $ < 25M P R E C L I N I C A L PHASE 1 PHASE 2 PHASE 3 AP P R O VAL CO M M E R CI A L 5

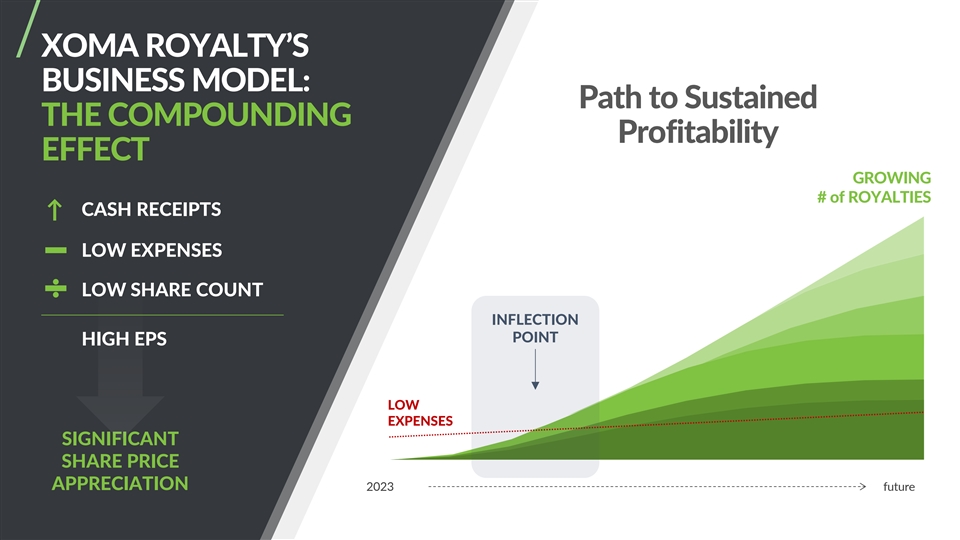

XOMA ROYALTY’S BUSINESS MODEL: Path to Sustained THE COMPOUNDING Profitability EFFECT GROWING # of ROYALTIES CASH RECEIPTS ↑ LOW EXPENSES LOW SHARE COUNT INFLECTION POINT HIGH EPS LOW EXPENSES SIGNIFICANT SHARE PRICE APPRECIATION 2023 future 6

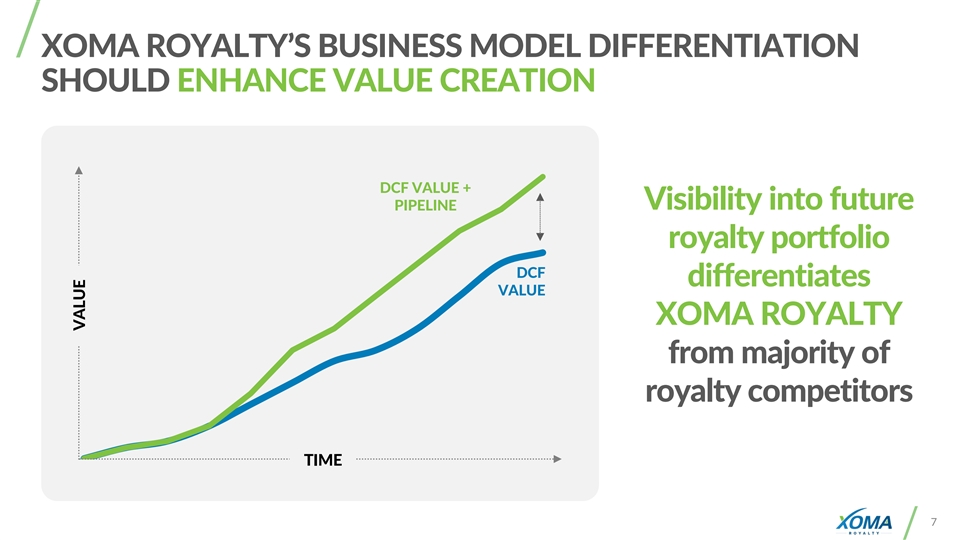

XOMA ROYALTY’S BUSINESS MODEL DIFFERENTIATION SHOULD ENHANCE VALUE CREATION DCF VALUE + Visibility into future PIPELINE royalty portfolio DCF differentiates VALUE XOMA ROYALTY from majority of royalty competitors TIME 7 VALUE

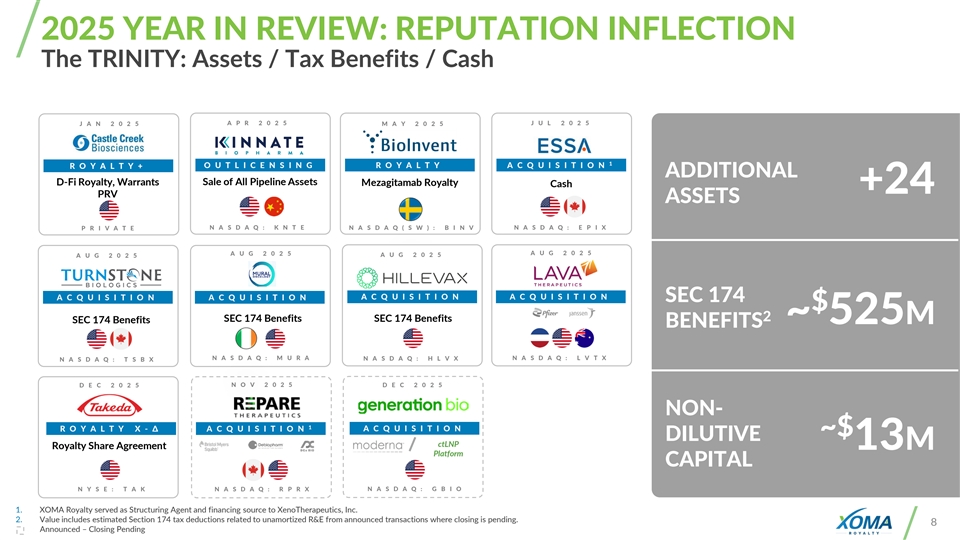

2025 YEAR IN REVIEW: REPUTATION INFLECTION The TRINITY: Assets / Tax Benefits / Cash A P R 2025 J U L 2025 J A N 2025 M A Y 2025 1 O U T L IC E N S IN G R O Y ALT Y A C Q U IS IT IO N R O Y ALT Y + ADDITIONAL D-Fi Royalty, Warrants Sale of All Pipeline Assets Mezagitamab Royalty Cash +24 PRV ASSETS N A S DA Q : K N T E N A S DA Q : E P I X P R I VAT E N A S DA Q ( S W ) : B I N V A U G 2025 A U G 2025 A U G 2025 A U G 2025 A C Q U IS IT IO N A C Q U IS IT IO N A C Q U IS IT IO N A C Q U IS IT IO N SEC 174 $ 2 SEC 174 Benefits SEC 174 Benefits SEC 174 Benefits ~ 525M BENEFITS N A S DA Q : M U R A N A S DA Q : L V T X N A S DA Q : T S B X N A S DA Q : H L V X N O V 2 025 D E C 2025 D E C 2025 NON- 1 R O Y ALT Y X -Δ A C Q U IS IT IO N A C Q U IS IT IO N ~$ DILUTIVE ctLNP Royalty Share Agreement 13M Platform CAPITAL N Y S E : T A K N A S DA Q : R P R X N A S DA Q : G B I O 1. XOMA Royalty served as Structuring Agent and financing source to XenoTherapeutics, Inc. 2. Value includes estimated Section 174 tax deductions related to unamortized R&E from announced transactions where closing is pending. 8 Announced – Closing Pending

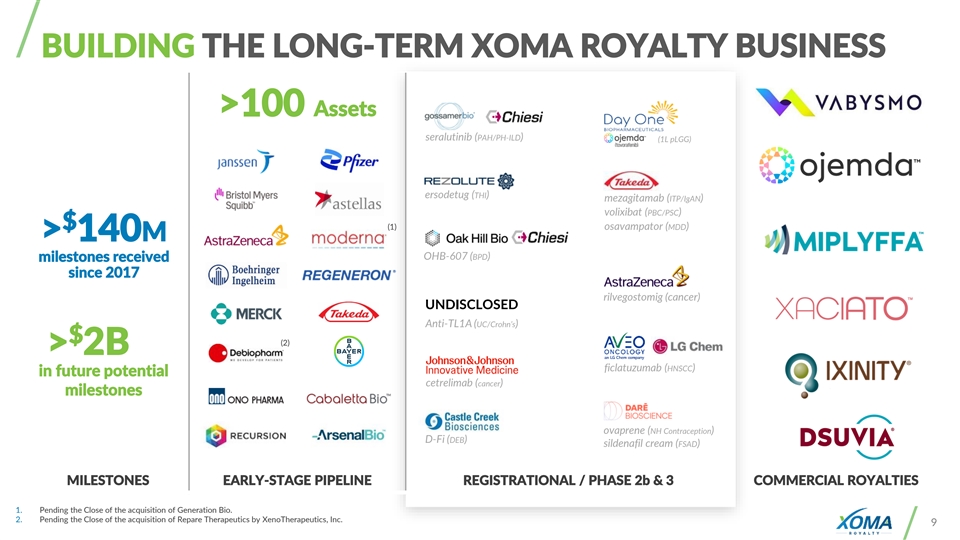

BUILDING THE LONG-TERM XOMA ROYALTY BUSINESS >100 Assets seralutinib (PAH/PH-ILD) (1L pLGG) ersodetug (THI) mezagitamab (ITP/IgAN) volixibat (PBC/PSC) (1) $ osavampator (MDD) > 140M OHB-607 (BPD) milestones received since 2017 rilvegostomig (cancer) UNDISCLOSED Anti-TL1A (UC/Crohn’s) $ (2) > 2B ficlatuzumab (HNSCC) in future potential cetrelimab (cancer) milestones ovaprene (NH Contraception) D-Fi (DEB) sildenafil cream (FSAD) MILESTONES EARLY-STAGE PIPELINE REGISTRATIONAL / PHASE 2b & 3 COMMERCIAL ROYALTIES 1. Pending the Close of the acquisition of Generation Bio. 2. Pending the Close of the acquisition of Repare Therapeutics by XenoTherapeutics, Inc. 9

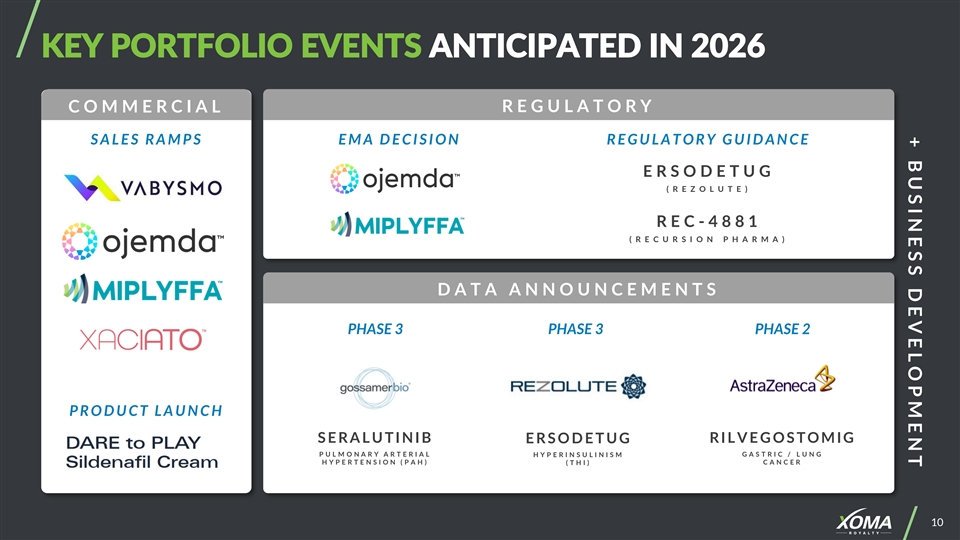

+ B U S I N E S S D E V E L O P M E N T KEY PORTFOLIO EVENTS ANTICIPATED IN 2026 R E G U L A T O R Y C O M M E R C I A L S A L E S R A M P S E M A D E C I S I O N R E G U L A T O R Y G U I D A N C E E R S O D E T U G ( R E Z O L U T E ) R E C - 4881 ( R E C U R S I O N P H A R M A ) D A T A A N N O U N C E M E N T S PHASE 3 PHASE 3 PHASE 2 P R O D U C T L A U N C H S E R A L U T I N I B R I L V E G O S T O M I G E R S O D E T U G P U L M O N A R Y A R T E R I A L H Y P E R I N S U L I N I S M G A S T R I C / L U N G H Y P E R T E N S I O N ( P A H ) ( T H I ) C A N C E R 10